AI-led growth

Rethinking growth and go-to-market in the age of AI

Rapid improvements in AI create new vectors of attack and new moats of defensibility.

While much has been written on how AI revolutionizes products, there's relatively less focus on how it transforms the way products go-to-market.

AI has the potential to create entirely new go-to-market paths.

But amidst the current AI hype, we’re susceptible to over-predicting where this is going to happen and under-appreciating where the opportunity actually lies.

To understand where AI can and cannot create new paths to the customer, we need to understand the fundamentals mechanics of a new form of growth: AI-led growth.

Let’s get stared!

But first…

Platforms in the age of Generative AI

The core focus of my work this year is the intersection of platforms and AI.

I’m traveling on a speaking tour of the US coastal states during July and August 2024 to speak on this topic.

Download a detailed brochure of speaking topics and advisory structures.

Current client engagements for the tour have been booked in Seattle, SF, LA, Portland, Vancouver, Boston, and New York.

If you’ve liked my work on this topic and would like to engage, get in touch below.

Three sources of advantages in B2B ecosystems

Ok, let’s get back to AI-led growth.

To understand that, we need to start with how B2B channels work today.

In How to win at Generative AI, I call out three sources of advantage in B2B ecosystems.

Relationship advantage: Do you have primacy of relationship with the key stakeholder?

Workflow advantage: Do you own the core workflow?

Intelligence advantage: Do you inform the core decision?

The evolution of B2B platforms (and products) over the past four decades has progressed along these three advantages.

Enterprise software - The relationship advantage

Enterprise software providers primarily operated on a relationship advantage.

They would build large sales teams, arm them with wining-and-dining budgets, and engage in long sales cycles to sell millions of dollars worth of software contracts. Enterprise-level buyers would buy software and force it onto users in the enterprise.

Cloud-hosted software - The workflow advantage

Around the mid-2000s, the rise of the cloud and the ability to host software in the cloud started creating another form of advantage - a workflow advantage.

Unlike enterprise software, which was clunky, took years to implement, and provided relatively low flexibility once implemented, cloud-hosted software (as-a-service) could be updated and versioned without worrying about individual implementations. User experience could be constantly improved. Most of all, cloud hosting enabled a fundamentally different path to market. Users could try out the software before buying it. They could get on to pay-as-you-go pricing programs and scale up or scale down their usage.

This shift in advantage was accompanied by a shift in the dominant growth model. Enterprise software was dominated by sales-led growth. Cloud-hosted software could leverage product-led growth i.e. the product itself was sufficient to drive growth for the business.

Product-led growth positions the product as the primary driver of customer acquisition, retention, and account expansion.

I’m not a big fan of the term ‘product-led growth’ - but it caught on largely because it pitted this new breed of startups against the old guard. The new breed didn’t need salespeople in suits traveling business class and racking up credit card points on company budgets. Instead, all you needed was engineers in hoodies working with designers who were constantly focused on improving the trial experience, improving conversions, reducing churn, and so on.

AI - The intelligence advantage

We’re now entering a new phase where the growth model is poised to shift again.

But if you’re largely focused on the ‘sales-led’ vs ‘product-led’ distinction, the shift may not be all that obvious.

However, going back to our original framework of three primary sources of advantage:

The first shift from sales-led growth to product-led growth was largely a shift from leveraging a relationship advantage to leveraging a workflow advantage.

Underpinning the next shift is a shift to a new form of advantage - a shift from workflow advantage to intelligence advantage.

Here’s how to think about what really changes with AI-led growth:

Viewed purely as a distinction between sales-led and product-led, the distinction may not be clear - AI is essentially embedded in the product.

But the shift is important for another reason. If AI can help capture the core decision that your customer engages in, it can create a new path to the customer.

What is AI-led growth?

AI-led growth involves

(1) gaining the right to inform the user on their core decision (or entirely absorbing the decision away from them) and

(2) leveraging that right to expand across a range of other use cases.

AI-led growth creates a new opportunity to gain customer adoption.

Product-led growth shifted focus away from capturing buyer relationships to gaining user workflows.

AI-led growth shifts focus away from capturing user workflows to developing the intelligence to inform the user’s most important (and underserved) decision.

This has important implications.

How AI-led growth attacks sales-led growth

In industries where relationships are still critical to gaining customer trust and closing the sale (e.g. reseller relationships), AI can unlock a new sales channel if it creates a new path to the customer.

These industries typically still operate on a sales-led growth model because sales agents and resellers possess specialized knowledge about the product and/or the customer context based on which they continue to own the right to sell, and the product is too complex to be sold on a try-before-you-buy model.

AI-led growth attacks these industries when a sufficiently sophisticated AI sales assistant, empowered with product knowledge (trained by the company) and customer knowledge (trained by resellers) can take over the sales channel.

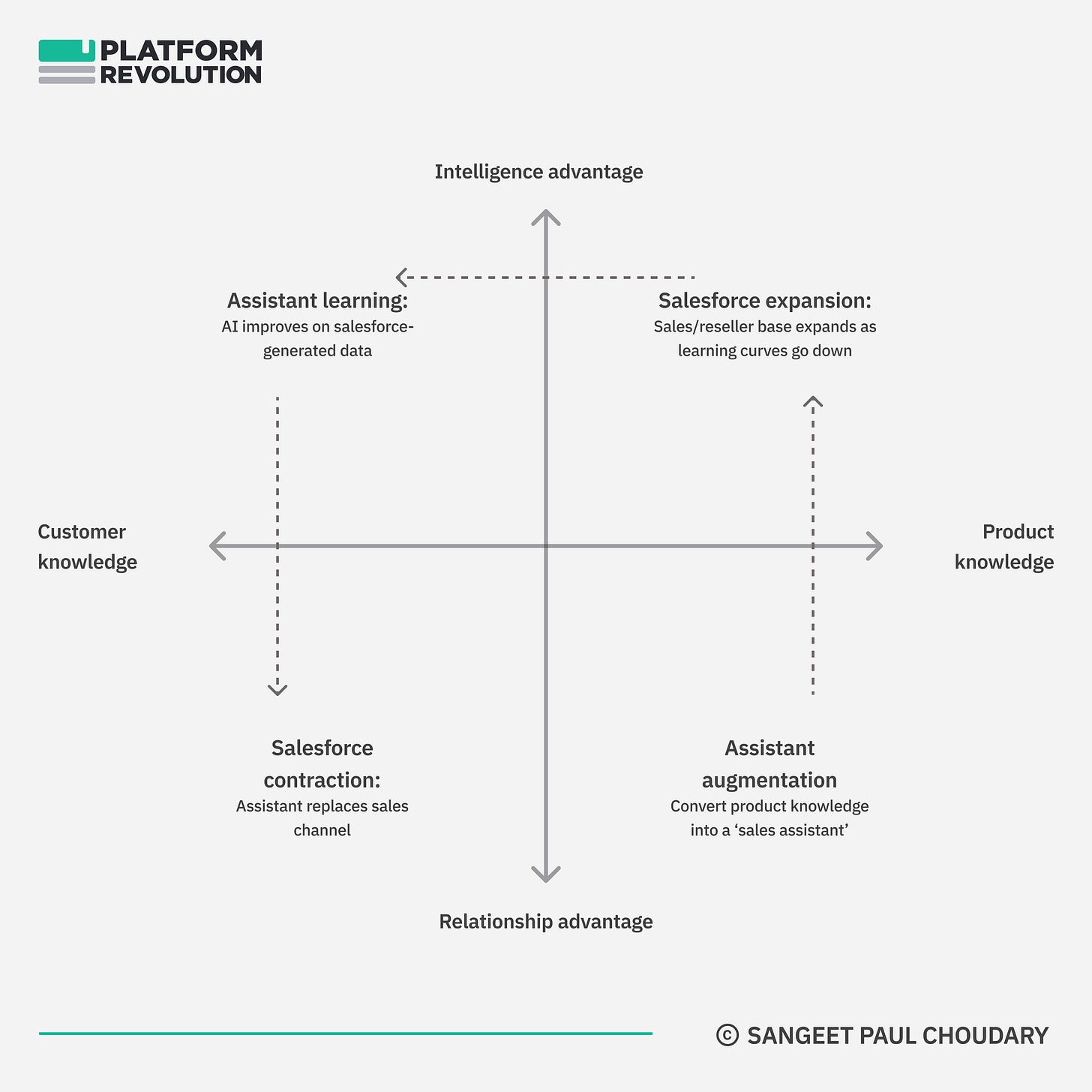

This plays out in four stages:

Stage 1 - Assistant augmentation: The company converts its product knowledge into a ‘sales assistant’ - an AI assistant which assists salesforce and resellers with the product.

Stage 2 - Salesforce expansion: The reseller/salesforce dramatically increases as learning curves go down for new resellers who no longer need extensive training to sell the product.

Stage 3 - Assistant learning: This widening base of salesforce and resellers using the AI sales assistant rapidly create data about different customer needs as they work with the assistant to address them.

Stage 4 - Salesforce contraction: Once sufficient customer data has been captured, the assistant is sophisticated enough to replace sales channels and serve the customer directly.

At various points across these four steps, the actual ‘product’ form of AI may take one of two shapes:

Replacing the current channel (prospective customer interacts with AI assistant) or

Embedding in the current channel (AI assistant augments sales manager).

Essentially, across the four stages, we’re moving from a relationship advantage towards an intelligence advantage, which we then leverage to gain back and create a new relationship advantage.

Of course, if a competitor already has customer knowledge through some other mechanism, they can directly attack and collapse the above process down to Step 4. But in most cases, a shift from sales-led growth to product-led growth - in the absence of ‘unfair’ data advantages - will follow this path.

To the extent that relationship advantages are based on specialized knowledge, AI-led growth launches new attack vectors to create a new path to the customer. Firms that resist these channels may find their path to the customer taken over by firms that do.

How AI-led growth attacks product-led growth

In industries where customers are locked-in to workflows, critical decisions for the customer may sit in those workflows but may be underserved within them. By empowering customers with those decisions, AI can unlock a new sales channel.

A product-led growth model relies on creating massive improvements in the user workflow. In doing so, it targets users of the product, not the corporate buyers.

Users can try before they buy. Seat-based pricing further incentivizes this path as users can pay smaller subscription fees using a corporate credit card and avoiding complex procurement.

Eventually, corporate buyers get involved only when sufficient number of users are on board. By that time, the workflow is deeply embedded in the organization and is difficult to unseat. Usage influences purchase. Product-led growth beats sales-led growth.

AI-led growth attacks these industries when a sufficiently sophisticated AI ‘decision support system’, empowered with product knowledge (trained by the company) and customer knowledge (trained by end users) can take over the sales channel.

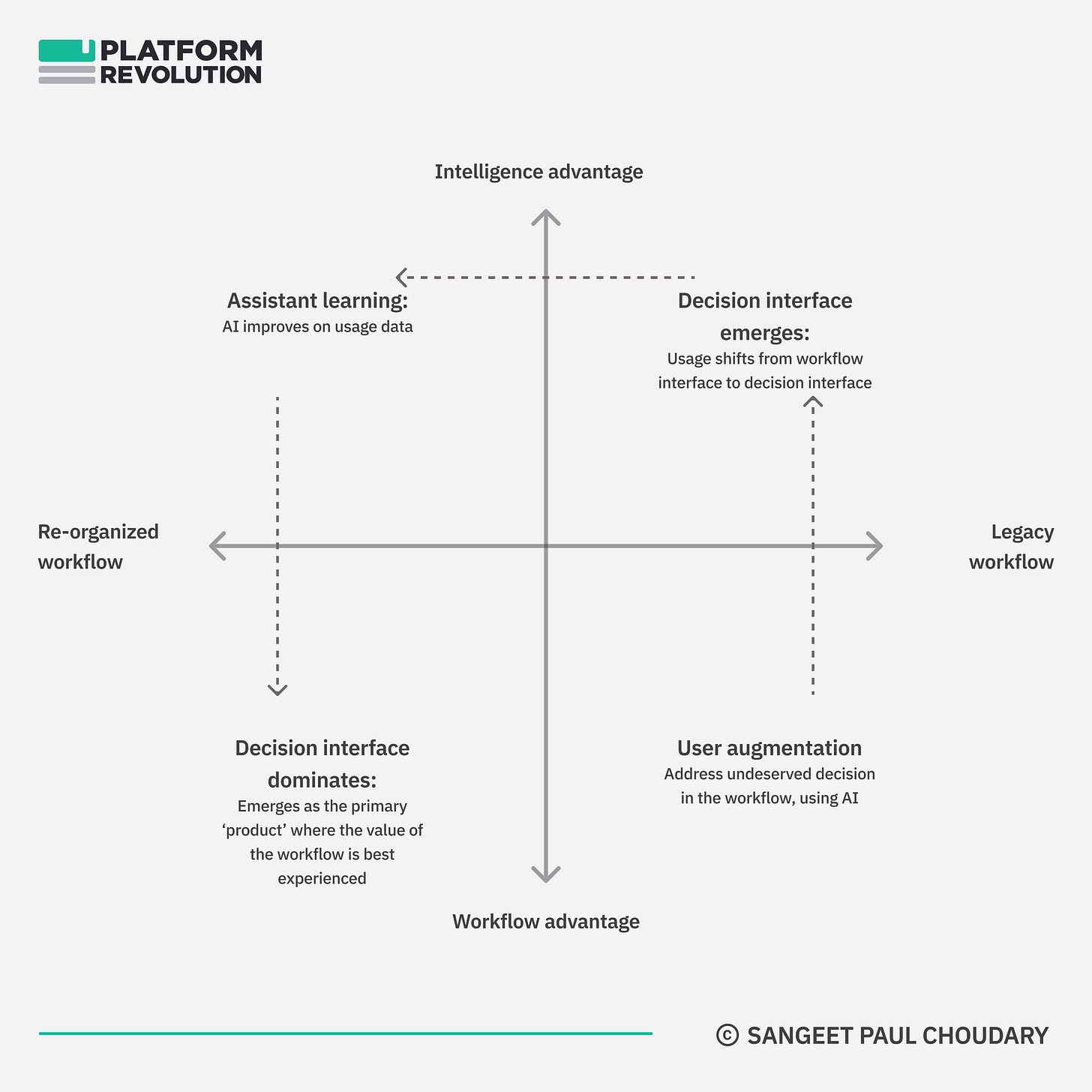

This plays out in four stages:

Stage 1 - User augmentation: The company embeds a third party AI assistant and trains it on its product knowledge.

Stage 2 - Decision interface emerges: The AI assistant starts enabling an important and underserved decision in the workflow. Where this happens, usage may start shifting from the workflow interface to the decision dashboard. Users increasingly start their journey with the decision dashboard.

Stage 3 - Assistant learning: The more users that come on board, the more this assistant is trained. This widening user base using the AI assistant rapidly creates data about different user needs and the assistant learns from them as it works alongside them. As the AI improves and usage shifts to the decision dashboard, the rest of the workflow starts getting reorganised around the decision dashboard.

Stage 4 - Decision interface dominates : As the AI assistant and decision dashboard improve, the decision dashboard may eventually emerge as the primary ‘product’ where the value of the workflow is best experienced.

This is what this looks like:

Winners and losers with AI-led growth

This brings us back to my favourite question. Where do power and profits shift? Who wins and who loses?

Salesforce and resellers: LOSE - In the short run, we may see them winning. In the long run, they lose. Not necessarily because they are entirely replaced, but because their sales commissions will go down. Their ability to charge a premium gets eroded.

This is an extension of the most popular thesis on this newsletter:

Sales-led companies: WIN/LOSE - The corollary to the above is that the sales-led companies that successfully move to AI-led growth will win as their cost of customer acquisition and retention dramatically falls. Conversely, the sales-led companies that fail to make this transition lose because a competitor ends up building this path to market.

Vertical sales assistant AI providers: WIN - These players stand to benefit from the shift to AI-led growth. However, to get this right, they will have to get customers (product creators) on board. And that is where vertical advantages will play a key role. Sales assistant AIs that already have deep vertical advantages will be more likely to be selected by enterprises that care about not compromising their sales channels.

This is an extension of another popular thesis on this newsletter:

Horizontal AI assistants: LOSE - LLMs feel like fun when you’re a consumer. But their hallucinating responses can wreak havoc in sales channels and destroy customer trust. If you’re not convinced, ask Air Canada.

Product-led workflow incumbents: WIN/LOSE - Saas workflow providers that benefit from product-led growth will need to assess where they stand. If they already serve the most important user decisions within their workflow, they can use AI to improve their positioning. If the most important user decisions in the workflow are currently underserved, they can seize that opportunity with AI. The ones who do can extend their workflow advantages to now win with an intelligence advantage. The ones who don’t may risk getting displaced by AI-led challengers.

This is an extension of the incumbent bundling thesis below:

AI-led workflow challengers: WIN/LOSE - Finally, where do the AI startups stand? This is the corollary of the above case. First, ask yourself:

Is the decision problem you are trying to solve truly underserved. If not, you LOSE.

Is this underserved decision currently sitting inside a workflow served by an incumbent? Or is the workflow also underserved? If undeserved, you have a shot at a WIN.

If the workflow is currently served by an incumbent, who has the data advantage require to address this decision? The challenger or the incumbent? If the incumbent has a data advantage and a workflow advantage, you could LOSE. If the incumbent doesn’t have a data advantage, you have a shot at a WIN.

If you’d like to visit the overall thesis on winners and losers in Gen AI, have a look at this:

This summer, AI meets the platform economy

I hope you’ve enjoyed my work on AI. The key focus of my work this year is explaining the intersection of platforms and Gen AI.

I’m traveling on a speaking tour of the US coastal states during July and August 2024 to speak and advise on this topic.

Download a detailed brochure of speaking topics and advisory structures.

Current client engagements for the tour have been booked in Seattle, SF, LA, Portland, Vancouver, Boston, and New York.

If you're in and around those cities and would like to engage, I would love to hear from you.

Your conclusions about the sales disruptions with winners and losers are spot on, but I think the setup of the three B2B advantages is off timeline-wise:

- The relationship advantage only comes into play after the enterprise deal is done. At that point, it becomes a lock-in/legacy/switching cost advantage. The complexity of these solutions explains slow sales cycles (and FUD.) You have large vendor teams throwing money into win big accounts. It's a pitched battle (at least, it should be.) The relationship advantage does play if a very senior exec comes in with an agenda and pre-existing relationships, and can ram it down the organization's throat. This happens especially with execs who bring "their" consultants. In the digital era with winner take all solutions, it also becomes a "brand advantage."

- The workflow advantage is really the simplicity advantage. I refer to Porter's "What is Strategy?" language and say it is "access-based." It's just easy to put because it is a simple product for a solution. Salesforce on the cloud killed the other CRMs like Siebel like this. Then they created a relationship advantage. :)

- The intelligence advantage is most interesting in two ways. First, the product is superior. For example, I worked with a predictive demand planning tool that was just better than anything else out there, head to head. Second, the sales process and the related selection and analysis processes can and should be augmented. It's shocking... just shocking... the number of implementation turnaround projects I've done because the clients didn't really know what problem they were solving at a high level, and missed critical details in the solutioning. In other words, they missed the forest AND the trees in selecting software! Augmentation would make for smoother implementations and trusted relationships. Instead, we have to hear euphemism excuses about agile and scrums.

I do think there are interesting start-ups that can replicate/replace what consultants do in helping to select software and also complete the early-stage designs. Instead of go-to-market, the process is go-to-solution.

Hi Sangeet Paul - Not sure if you have noticed but the link to your website does not work - https://platformthinkinglabs.com/advisory/.

Pls have it checked.