Asset-heavy strategies in the platform economy

How traditional firms can also restructure industry economics

Last week’s newsletter on value stacks in the financial services space seems to have resonated with a lot of readers. Quite a few wrote back talking about how they see similar shifts underway in their own industries (industries ranging from automotive to child adoption).

I wanted to follow that up with another interesting analysis on applying value stacks to create competitive strategy, particularly for asset-heavy firms.

One of the early myths of the platform economy was the myth of asset-lightness. It sounds cool to say that the world’s largest media company doesn’t produce content and the world’s largest retailer doesn’t carry inventory, but the truth is much more nuanced. Supply-side advantages reinforce demand-side advantages. Amazon’s asset-heavy warehousing network makes its Prime proposition possible, which in turn creates a defensible network effect as Prime users do not switch easily.

It’s important to understand asset-heavy strategies in the platform economy. Most incumbents cannot afford to shed assets. Nor should they have to.

Instead, they should strategize new positions for those assets in the future value stack that they want to compete in.

This analysis was first covered in my State of the Platform Revolution 2021 report and looks at an interesting example of an incumbent that leveraged its assets across the value stack to eventually create a vehicle for others to invest in and partner with. (Download the full report here)

So let’s dive right in…

Old Oil is the New Tech

During the pandemic-ravaged summer of 2020, many of Silicon Valley's top tech giants (and leading investment firms) invested more than 20 billion dollars in Reliance Jio, a seemingly traditional telecom company in India. Over the course of 14 weeks, the company raised capital from Facebook, Google, Intel, Qualcomm, and a host of investment firms.

This was all the more confounding because Reliance was essentially playing a traditional telecom game and building an asset-intensive business. Since the mid-2000s, the telecom industry has been impacted by two waves of disruption, first when Apple and Google built their app platforms and next when Skype, WhatsApp, and other providers of free communication services eroded traditional telco revenue streams. Many have hailed this as the rise of the platform business, the shift from asset-intensive to asset-light businesses, and the rise of over the top (OTT) players.

The results had been declared. Telcos had lost the game and had gotten relegated to commoditised, asset-intensive businesses while the bigtech firms had won with asset-light platform business models.

Why then were the same BigTech firms scrambling to invest in a traditional telecom business, no less one that had invested more than $30 Bn in building out traditional telecom infrastructure and had more than $20 Bn of debt on its books?

Industry observers tried hard to explain this. Some heralded this as the triumph of ‘free’ but couldn’t quite explain why that made any business sense. Others pointed to Jio’s investments in new digital services but struggled to explain its larger investment in 4G infrastructure. Some called this a new form of vertical integration but were further confounded when Jio opened up its most capital intensive asset - its 4G network - to its competitors, where vertical integration would have protected it.

None of these adequately explain Jio's strategy nor the tremendous upheaval it has brought about in India's telecom industry. Since Jio’s arrival, 4G has become the default network for most of India, with Jio accounting for ~70% of the country's 4G traffic. In less than 5 years, the company has amassed more than 400M customers and propelled India from #155 to #1 in the world in mobile data consumption.

Enjoying the post so far? Please feel free to share further.

From vertical to horizontal industry structures

To understand Jio’s strategy, we need to understand a deeper shift in industry structure that’s playing out across the economy.

Through most of the twentieth century, businesses scaled through vertical integration, integrating multiple activities across supply, production, and distribution. This offered greater control and greater capture of profits, and was a natural solution to the problem of transaction costs - costs incurred in coordinating activities across the value chain.

Transaction costs determine an industry’s structure - the manner in which firms organize themselves and interact with other players. To minimize transaction costs, most firms engaged in vertical integration.

Most industries, accordingly, took on a vertical architecture with a few large vertically integrated firms competing with each other.

As digital technologies proliferate across industries, we’re seeing a fundamental shift in this architecture. Digital technologies enable cheaper inter-firm communication, greater interoperability, and higher standardization. These factors together reduce transaction costs and enable firms to more effectively coordinate without requiring vertical integration or bilateral contracting.

As a result, the links in the vertically integrated value chain start to break up and new specialized competitors emerge that are more agile and innovative in delivering a specific task in the value chain. The vertical industry architecture is increasingly giving way to a more horizontal ‘layered’ architecture where firms at every layer specialize in a particular value creating activity, and where firms, across layers, are organized towards a common value creation goal.

Waves of Telco disruption

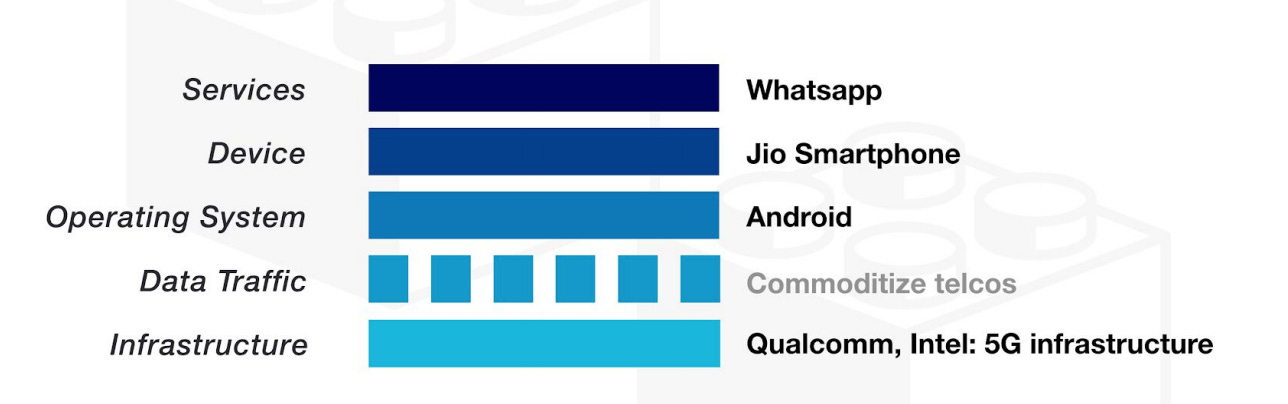

The mobile communications industry has itself weathered this shift. The vertical structure of the telecommunications industry was first dismantled by Apple and Google, which dominated the horizontal operating system layer, and subsequently by Whatsapp and Skype which dominated the communications services layer at the top. These shifts relegated telecom operators and handset manufacturers to commoditized asset-intensive business models.

The response of telecom operators to these shifts have been predictable, with some trying to directly copy the new business models, while others resort to competing among themselves, launching aggressive price wars. None of these responses acknowledged the new competitive landscape, as telcos grew increasingly commoditized. That is, until Jio came along.

Jio invested more than $30 Bn in setting up cell-phone towers and laying out a country-wide fibre-optic network. It launched the world’s cheapest 4G phone and set up deals with 20 smartphone manufacturers to bundle its SIM card. It then made a series of investments in digital services, investing more than $3 Bn in upcoming startups.

Jio was pursuing a strategic selection of business positions and a calculated choice of competitive moves that acknowledged the new value stack and positioned Jio for domination across multiple layers.

Value stack for your industry

This post lays out some of the core principles of value stack analysis.

If you’d like to learn more about our work on ecosystem value stack analysis, check out our Advisory page or request our Advisory kit to get more details on our analysis and approach.

Jio’s value stack

At the infrastructure layer, Jio’s aggressive investment monopolized 4G infrastructure in India, unleashing data consumption across the country, which now is the second largest internet market in the world after China and also the one with the lowest data tariffs. At the device layer, Jio built out the world’s cheapest feature phone on KaiOS, a Hong Kong-based operating system, deliberately avoiding the Android operating system to minimize dependence on a third party. At the communications layer, Jio massively subsidized voice calls as well as data tariffs, triggering a price war that consolidated the industry and accorded Jio the leadership position at that layer.

Having gained 400M users across India with a monopoly at the infrastructure layer and a dominant position at the communications layer, Jio reached out to investors painting a full picture of the ecosystem with the specific positions each investor would occupy within it. Intel and Qualcomm would further strengthen Jio’s bid to not just expand to 5G but also become a global exporter of the technology and an alternative to Huawei. Google, now with a seat at the table, would help build out a low-cost smartphone, enabling domination of the OS and device layers. Facebook, most importantly, would provide user-facing services and position Whatsapp as a ‘super app’ within which all apps would sit.

Economic value in ecosystems

Jio’s example demonstrates how comprehensive ecosystem strategies will increasingly define the next generation of industry winners.

Economic value is increasingly created not within individual firms but through the interactions among firms across the ecosystem. Understanding value creation at the level of the ecosystem is more important than merely understanding it at the level of a single firm. Competitive advantage, in turn, is no longer determined merely by a firm’s activities but by the layers those activities occupy in the value stack.

In this new landscape, power concentrates with players that dominate a specific layer. The strongest players leverage their dominance at one layer to occupy multiple positions across different layers without requiring traditional vertical integration. Firms can effectively excel at both innovation and efficiency by choosing a combination of such positions.

Reliance Jio demonstrates that incumbents may leverage their deep infrastructural and regulatory moats and partner with BigTechs to dominate the ecosystem together. It also demonstrates the sobering reality that such large ecosystem plays require a bold vision, an appetite for high-risk investment, and the execution chops to scale and dominate rapidly.

Applying asset-heavy strategies to platform ecosystems

Value stack analysis applies across industries, and is particularly useful when considering asset deployment strategies. Should a retailer divest its locations? Should a company’s IP be open-sourced? Should a logistics firm manage fleets or just license fleet management software?

All incumbents face such asset deployment questions.

Understanding value layers in your ecosystem and strategising across those value layers is critical in determining where to own assets and where to divest them. Over the past several years, we’ve advised a wide variety of firms on their asset-heavy ecosystem plays, across ecosystems as diverse as smart mobility, decentralised energy, logistics, construction, education, healthcare, and consumer goods.

If you’d like to learn more about our work here, check out our Advisory page or request our Advisory kit to get more details on our analysis and approach.