Digital business ecosystems have become increasingly important over the past decade, yet they remain poorly understood. Business ecosystems are systems of interacting actors which coordinate their activities towards solving an end user problem.

To strategize for an ecosystem, you need to map out the ecosystem, understand where value lies/concentrates within that map, and strategize future positions based on your legacy assets and your future ambitions.

Over the past decade, I’ve advised many firms in mapping their ecosystem and identifying business models where value concentrates. Academics and consultants use a wide range of mapping techniques to map value flows and model ecosystem activity.

Often, the greater the complexity of this mapping, the more it discourages eventual action on the part of the firm in question.

Instead, using a simple framework to demystify ecosystems is more effective in helping firms strategize and act, and also offers a starting point to unpack further nuance from.

In this edition of the newsletter, and in the upcoming deep-dive report on this topic, I lay out this simple framework, which has served as a great starting point for mapping out ecosystem business models.

Let’s dive right in!

But first, if you’re reading this for the first time, subscribe now to get these weekly insights straight to your inbox:

Now get full copy of the Ecosystem Playbook here!

The rise of ecosystems

To start with, it’s helpful to understand what’s really driving the shift to ecosystems. As I explained in my teardown of the financial services value chain:

As transaction costs fall with the emergence of new digital infrastructures and new mechanisms to organise the market, the vertically integrated value chain starts to unbundle.

This unbundling of the vertically integrated industry architecture creates a more modular, layered ecosystem where firms at every layer specialise in a particular value-creating activity.

So how do we think about platforms?

The rise of ecosystems moves value away from traditionally vertically integrated business models and instead drives value concentration in horizontal business models. We often refer to these business models as multi-sided platforms, as they create value by organizing interactions across different types of stakeholders across the ecosystem.

There is, however, further nuance here.

These horizontal business models perform different roles depending on where they emerge across the value chain.

In an ecosystem, we typically see three types of horizontal business models emerge - Aggregators, Integrators, and Infrastructures - which may be distinguished based on their position in the value chain. Additionally, firms may specialise and act as capability providers.

Let’s unpack each of these in turn.

Aggregators

Aggregators are consumer-facing business models, which

(1) aggregate consumer demand by

(2) building engagement and capturing data at scale through

(3) provisioning consumer-facing services.

The largest technology companies of the past decade - Facebook, Amazon, Netflix, Apple, Google - span multiple business model families but almost all of them established their dominance first as aggregators.

Facebook's social network created a high engagement consumer service to aggregate demand.

Amazon's Prime membership as well as its voice assistant Alexa are examples of aggregators that aggregate demand towards its commerce and media services.

Aggregators leverage their control over consumer relationships (and data) to mediate interactions between consumers and third party producers.

As ownership of consumer engagement becomes more scarce in a digital world, aggregators act as gatekeepers of market access for producers looking to interact with consumers.

Aggregators perform three key functions in a business ecosystem:

Provisioning of consumer services: Aggregators provision services to end consumers and engage consumers through data-driven personalization and habit design. For instance: Google’s search engine, Facebook’s news feed or Amazon Echo.

Managing consumer data insights: Aggregators capture consumer data at scale and provision this back as analytics to consumers (e.g. fitness applications) or as insights for producers (e.g. market insights provided to sellers by ecommerce platforms) or as targeting and advertising products (e.g. advertising products on Google and Facebook).

Matchmaking between producers and consumers: Aggregators match third party producers and their products/services to consumers, using data about both sides to facilitate the match. In doing so, they aggregate market-wide transactions at scale.

If you’re enjoying this article so far, consider sharing this further:

Integrators

Next, let’s look at integrators.

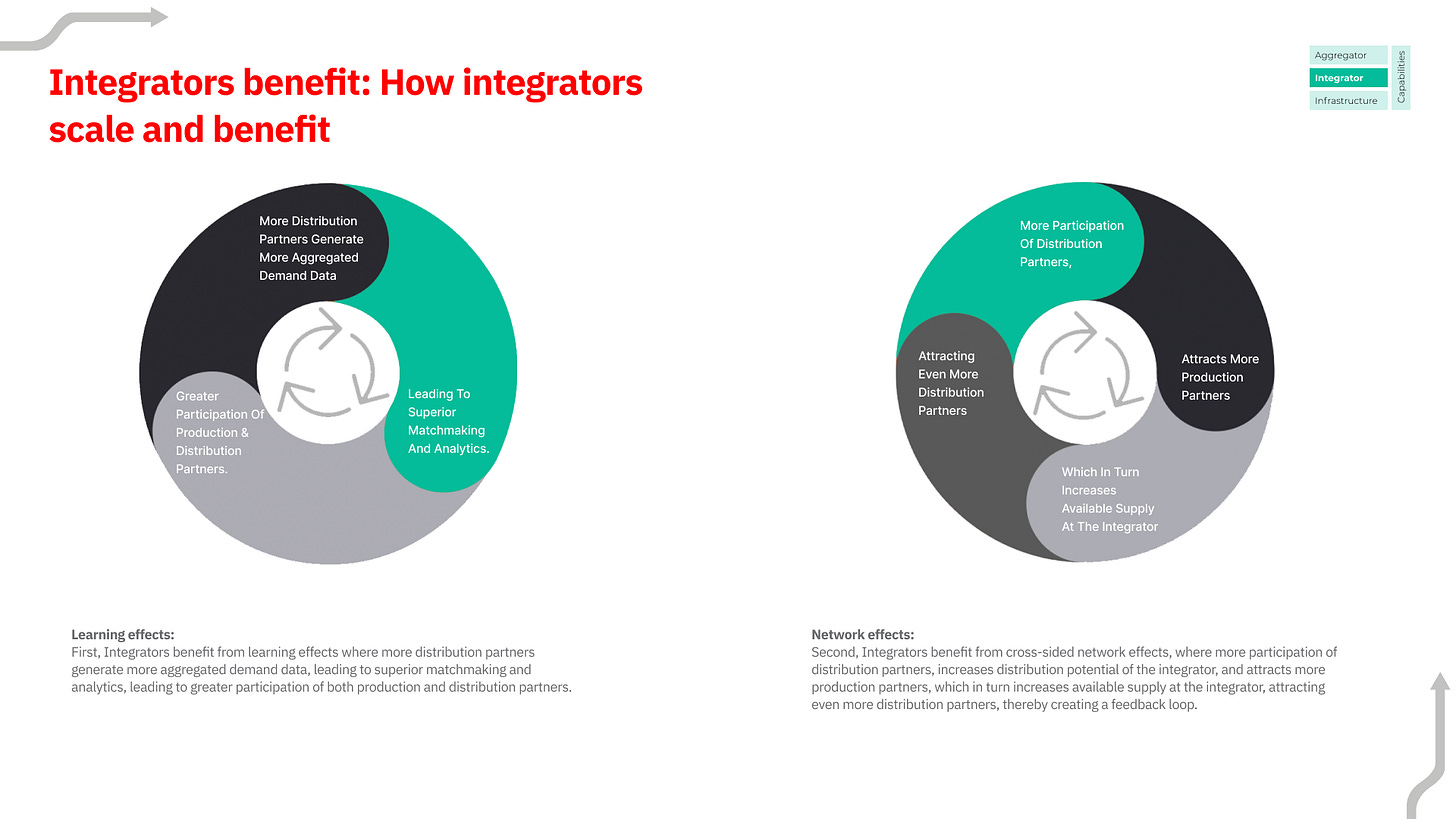

Integrators manage B2B ecosystem interactions between supply-side players (typically producers/manufacturers) and demand-side players (typically distributors) through the use of APIs.

Integrators act as switchboards integrating

(1) product provisioning APIs on the supply/production side with

(2) distribution environments (websites, apps, and other digital services) on the demand/consumption side.

In the travel distribution ecosystem, Amadeus and Sabre act as integrators, integrating across inventory providers (hotels, airlines etc) and distribution points (online travel agents).

In the financial services ecosystem, BAAS (banking as a service providers), like Galileo or Plaid, integrate across multiple financial services providing one-stop access to Fintechs and Ecommerce players looking for specific financial services.

Integrators provide an opportunity to bundle multiple services from diverse ecosystem producers and drive efficiencies by acting as a one-stop' distribution point' across an increasingly modular and diverse ecosystem.

Integrators perform three key functions in a business ecosystem:

Production side services integration: Integrators integrate services on the production side to deliver a one-stop storefront for distribution partners. Think of Banking-as-a-service platforms,

Data exchange: Integrators facilitate matchmaking and exchange of data between the production and consumption sides of the ecosystem, specifically between manufacturers/producers and distributors.

Consumer Analytics: Integrators may aggregate data across distributors in the consumption side of the ecosystem and provides analytics to production partners.

Infrastructures

Finally, let’s look at infrastructures.

Infrastructures provide core production infrastructure, standards, information services, and data assets to inform, coordinate, and support production activities that firms engage in.

Infrastructures include operating systems like iOS, compute infrastructures like AWS, commerce infrastructures like Shopify, coordination infrastructures like the Autodesk Construction Cloud, or data infrastructure like Google’s DeepMind.

Infrastructures coordinate the activities of ecosystem firms across a core production process, towards a common production output.

Infrastructures perform three key functions in a business ecosystem:

Formulate a future vision and ecosystem roadmap: They formulate a view of the emerging ecosystem and specify roadmap milestones that organize and support the ecosystem, allowing producers to align their own roadmap with these milestones. In particular, this is commonly observed with operating systems, which create and publish developer roadmaps enabling developers to coordinate their feature buildout in sync with the OS roadmap.

Provide knowledge services to the ecosystem: Infrastructures capture industry-wide data on production processes and are uniquely positioned to provide knowledge services to their ecosystem. Machine learning models are key assets managed by infrastructures and licensed as knowledge services to the ecosystem actors.

Expand to attract third party service providers on board: Consider, for instance, Amazon Web Services, which largely provides cloud computing infrastructure but also integrates and provides access to offerings from third party service providers through its AWS Marketplace. Shopify, another infrastructure, provides the infrastructure for merchants to run an online store, but also integrates third party logistics providers, through the Shopify Fulfilment Network.

Capabilities

Finally, firms may also choose to specialise in specific capabilities.

Capabilities focus on the performance of specific functions, that may be licensed to third party ecosystem actors, and may be embedded into aggregators, integrators, and/or infrastructures.

For instance, a financial services aggregator may leverage an external identity management capability while a healthcare infrastructure may leverage a healthcare diagnostic AI capability.

Capabilities are built around a core customer need. The customer may be an end consumer at the end of the value chain, or any intermediary consumer who consumes the service to deliver value further into the value chain.

Capabilities benefit from specialization. By focusing on a narrow set of functions, firms that scale out capabilities compete through specialization and out-compete other firms which perform multiple functions.

Capabilities may be offered on a capability as-a-service model, as APIs or licensable technology modules, to product developers or may be offered as a service directly to the end-user, as a connected product or service.

Capability providers perform three key functions:

Provisioning of capability: Capability providers need to develop IP or data advantage to deliver a non-commoditized capability at scale. For instance, Stripe provides a payments capabilities to third party aggregators (e.g.Lyft) and infrastructures (e.g. Shopify).

Architecting for ease of embedding: Capabilities, which are distributed through third party partners, need to be architected for ease of embedding. Developer ease of use is critical for adoption of capabilities across the ecosystem. Stripe’s developer resources and support have played a huge role in its wide adoption.

Managing capability usage data and insights: Capability providers also utilise data captured across the ecosystem to improve the functioning of the capability or to provide analytics and insights as an additional value proposition.

Platform positions across the value chain

As you’d note by now, all these business models have the potential to serve as multi-sided platforms. However, firms often make the mistake of looking at aggregators for inspiration when they might actually be building integrators or infrastructures.

For instance, many B2B platforms tend to be infrastructures or integrators but they often look at the BigTech aggregators for inspiration and end up making poor design choices.

Similarly, firms building integrators often over-estimate their ability to dominate a market by benchmarking their growth to the growth of consumer-facing aggregators.

This is a simple, helpful framework to identify where in the value chain you play and strategize accordingly.

Your ecosystem strategy

If you’re developing an ecosystem strategy and would like to explore our ecosystem mapping and strategy approach, please write in below requesting for our ecosystem mapping kit.

Through the next few essays, we’ll unpack this framework further by looking at specific case studies.

This series of essays eventually leads up to the launch of the Ecosystem Business Model.

Click on the link below to get access to the deep-dive report.