From Shopify to Unity: The picks and shovels of the new gold rush

Aggregators won the 2010s, Infrastructures will win the 2020s

Don’t mine gold when you can sell shovels!

In the as-a-service economy, everything is a shovel. When every function in the value chain can be modularized and provided as-a-service, it doesn’t take a genius to figure that while everyone joins the digital transformation ‘gold rush’, the vast majority of value will accrue to the ones selling the shovels.

The 2010s saw the rise of the aggregators, who profited by creating bottlenecks on consumer access.

The 2020s will see the rise of the infrastructures - the as-a-service ‘shovels’ that capture most of the profits while the rest of the economy scrambles for gold.

But first, to understand the platform economy in the 2020s, get your copy of the State of the Platform Revolution 2021 report:

And if you haven’t already subscribed to this newsletter, do subscribe to get early access to all our future reports and insights.

Standardization breeds commoditization

The differing motivations of aggregators and infrastructures boils down to where they make money. Aggregators monetize market access, infrastructures monetize the usage of creation tools and operating environments.

Aggregators standardize the transaction, and in doing so, commoditize the merchant producer. The more commoditized the producer, the better an aggregator can control the transaction. (Refer Theme #9 of the State of the Platform Revolution 2021 to understand how standardization breeds commoditization.)

A merchant starting out on the Amazon Marketplace in the mid-2000s would not have minded the standardization. Competition was low and Amazon provided much-needed market access. But as competition intensifies and multiple producers enter a category, triggering a price war, producers get increasingly commoditized and fail to build a brand.

The promise of the web as a distribution medium is not just in discovery of the long tail but in enabling the long tail to build influence (brand, following, reputation etc.) and level-up through this influence. Aggregators enable the former but discourage the latter.

Infrastructures, on the contrary, enable levelling-up through influence. The more you level up, the more infrastructure you are likely to consume.

While the economics of aggregators encourages standardization of the transaction, the economics of infrastructures favours producers who scale up, and as a result, consume more infrastructure over time.

This is the classic Amazon vs Shopify trade-off. In serving consumers by standardizing the transaction, Amazon increasingly commoditizes the merchant. The intense competition for the Amazon Buy Box is just one example of this dynamic.

Shopify’s revenue model, instead, benefits from the merchant levelling-up rather than getting commoditized. A merchant who levels-up demonstrates:

1) Higher infrastructure needs, requiring upgrade to a higher subscription tier

2) Need for additional financing, a key component driving Shopify’s land-and-expand revenue model, and

3) Need for a wider scope of solutions, provided by Shopify’s application partners.

It pays to be the infrastructure

As governments chase aggregators globally over antitrust issues (See Theme #8 of the State of the Platform Revolution 2021), infrastructures will have a field day spinning ‘don’t be evil’-style PR about ‘arming the rebels’.

That is until you realize that ‘arming the rebels’ or for that matter ‘arming everyone’ is the only way the shovels business makes sense. Digital transformation of companies will be a mixed bag. Some will hit gold and some will keep digging till they run out of runway. But both will buy shovels.

If you’re enjoying this post so far, please consider sharing it further:

Google aims at infrastructure, Apple positions itself for patient data aggregation

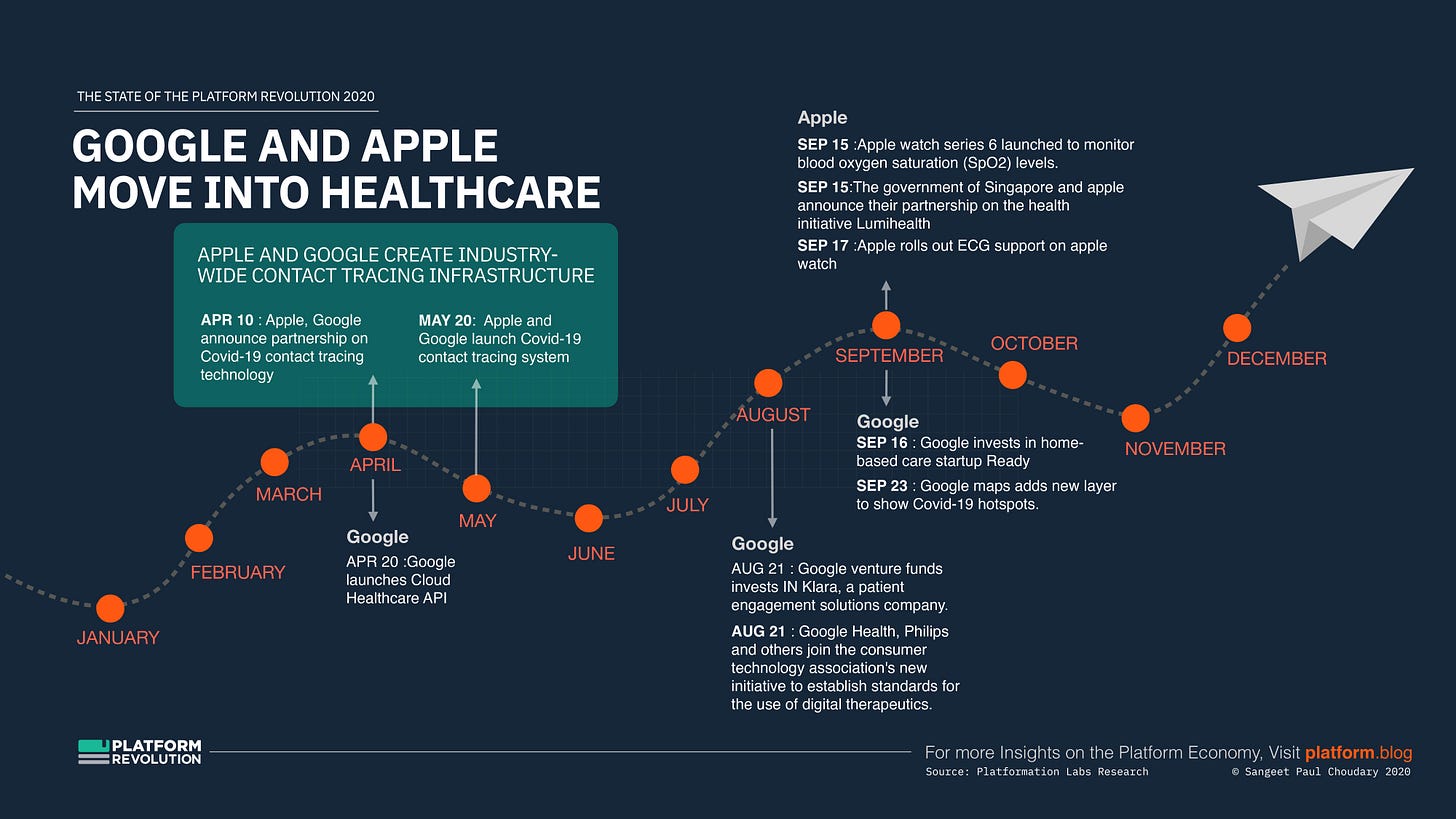

In Theme #4 of the State of the Platform Revolution 2021, I talk about how Covid-19 drove the adoption of digital infrastructure in the healthcare industry in 2020.

The contrasting strategies of Google and Apple in healthcare again demonstrate the two options of enabling market access vs providing infrastructure.

As explained in detail in the report, two key shifts - increasing data interoperability and improvements in AI and machine learning - are driving down coordination costs, leading to the rise of platforms in healthcare.

Apple, for instance, is pursuing a platform strategy centred around the Apple Health Record. Apple’s Health Record aims to be the central health record for users, combining data from acute care - currently stored in EHRs - with data from a variety of wellness and disease management devices and services, using FHIR-based integration. Apple’s partnerships with health systems and EHR vendors enable it to integrate EHR data with the Health Record. Apple also partners with Health Gorilla, a clinical data API exchange, to integrate diagnostic data.

Google's platform strategy involves provisioning clinical and operational infrastructure that underpins production across healthcare operations, diagnostics, drug R&D, surgery, and claims management. Google’s DeepMind enables access to diverse, siloed data in a standardized format, enabling a wider scope of data elements to be analyzed for clinical decision making. Google's infrastructure platform also includes capabilities like DeepVariant, which provides an open-source deep learning tool for genomic analysis, aimed at the life sciences industry.

A quick announcement before we continue…

Platform Scale for a post-pandemic world - a new edition of my first book, updated for the 2020s, was launched recently by Penguin RandomHouse. It’s currently available in India before launching globally.

You can read an excerpt on CNBC here.

Create… and Operate

Another way to think about infrastructures is to think of creation infrastructure vs operating infrastructure. Build environments vs runtime environments.

Unity, while best known as the leading game engine provider is another compelling infrastructure business, which extends across creation and operating infrastructures.

This is best explained in its S-1:

“Our Create Solutions allow creators to develop interactive, real-time 2D and 3D games and applications. We generate Create Solutions revenue principally through the sale of subscriptions to our products and related support services. Additionally, we offer professional services to our larger enterprise customers to assist them in creating content and applications, largely based on fixed-fee contracts.”

“Our Operate Solutions consist of a portfolio of products and services that offer customers the ability to grow and engage their user bases, as well as to run and monetize their content, with the goal of optimizing end-user acquisition and operational costs while increasing the lifetime value of their end-users. Nearly all of our Operate Solutions can be used whether or not the content is built using our Create Solutions. Fees from our Operate Solutions are typically billed monthly.”

Unity, though, is already extending this beyond gaming into other industries like automotive, manufacturing, and construction. Arguably, its Operate suite is very focused on gaming. They could possibly extend Operate infrastructures to other industries for training/education and for simulation.

Extending this argument beyond Unity, the ‘actual runtime environments’ of some of these more industrial sectors also present tremendous opportunity.

The Autodesk Construction Cloud aims to provide the creation and operation infrastructure for the construction industry. The actual runtime environment is a lot more messy. While Unity or Autodesk can possibly create a dominant position in construction training and simulation infrastructure, creating such a position in actual runtime (i.e. building operations management) requires data management across many third party systems using non-standardized, non-interoperable formats and involving logistical challenges in integration.

Trade wars will be won on digital infrastructure

Industrial sectors like construction present an enormous opportunity for infrastructures. In fact, as I’ve noted in many of the previous posts, future geopolitical posturing will rely less on sanctions and more on standards and digital infrastructure.

This is another important market for digital infrastructure providers.

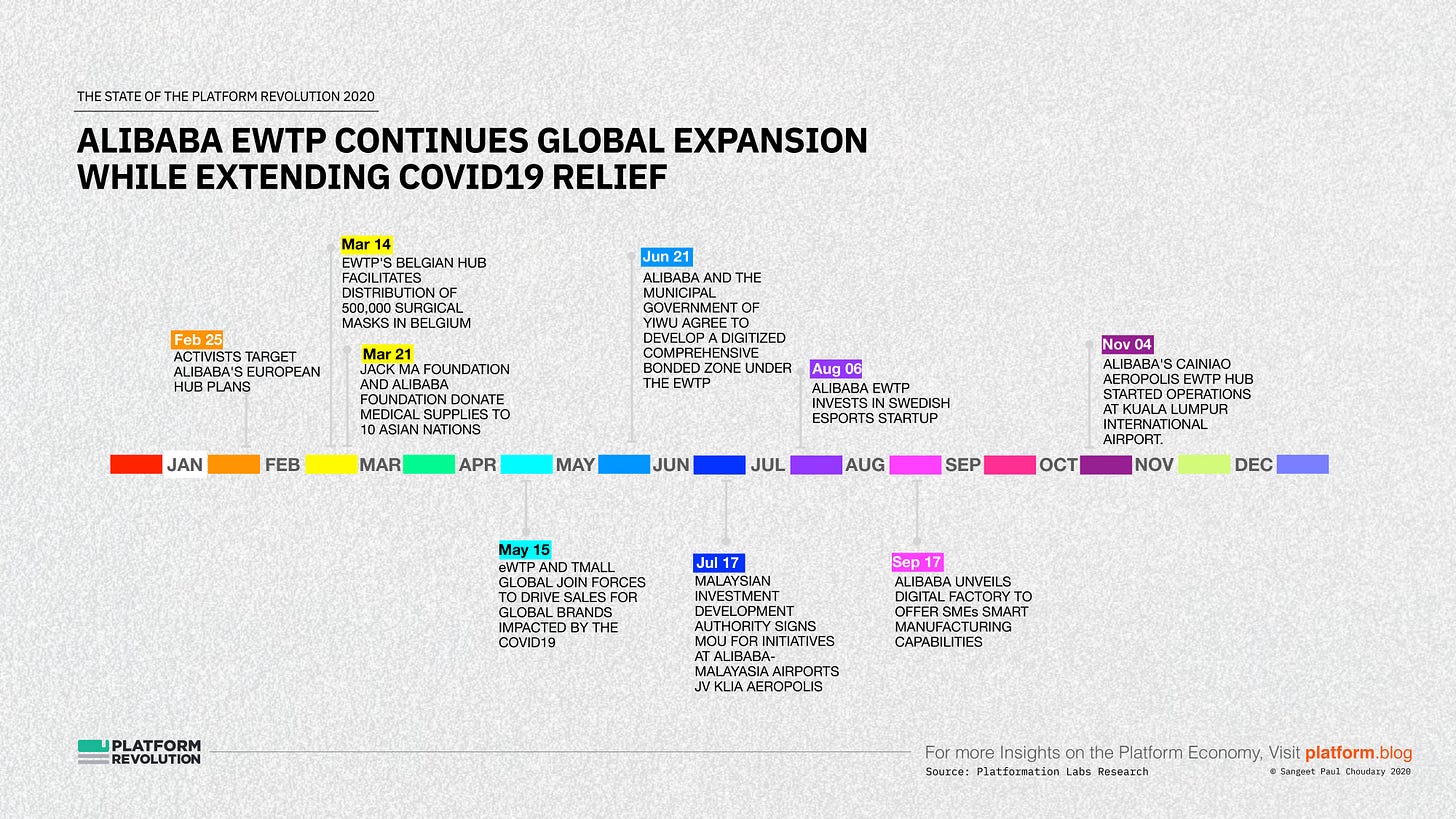

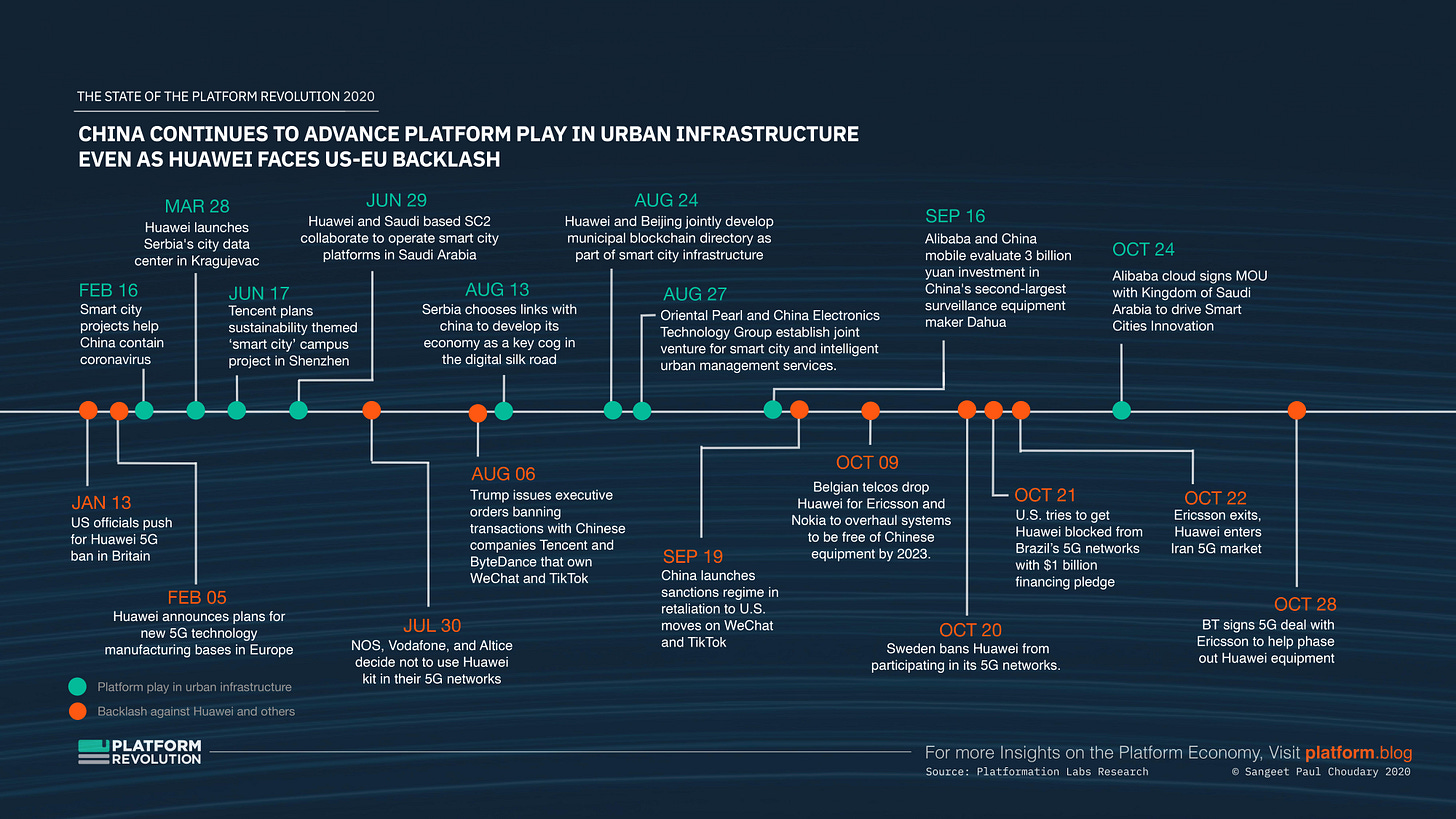

As we note in Theme #3 in the State of the Platform Revolution 2021, China’s future geopolitical moves rely a lot on the infrastructure plays of Alibaba, Ant, Huawei, and a handful of other large Chinese players.

Alibaba’s EWTP is its big infrastructure play where it looks to standardize global trade infrastructure. Alibaba is selling the picks and shovels for digital trade to countries around the world and connecting them back to its big trade hubs in China.

Meanwhile, Ant is providing lending and risk management infrastructure to financial institutions around the world.

Urban infrastructure is a third key segment as China extends its bid to embed its ‘operating system’ across the Belt and Road cities:

China’s digital infrastructure plays may gain tremendous scale with a handful of companies riding the Belt and Road wave and gaining scale across participating countries.

Aggregators drove stock market gains through the 2010s. I’m willing to bet that infrastructures - Unity, Shopify, Adobe, Agora, Stripe, Twilio, Microsoft, AWS, and others - will drive these gains through the 2020s. The digital transformation gold rush hit mainstream with Covid-19 but shovel sellers are still only starting to scale up.

If you liked this post, please consider sharing it further.

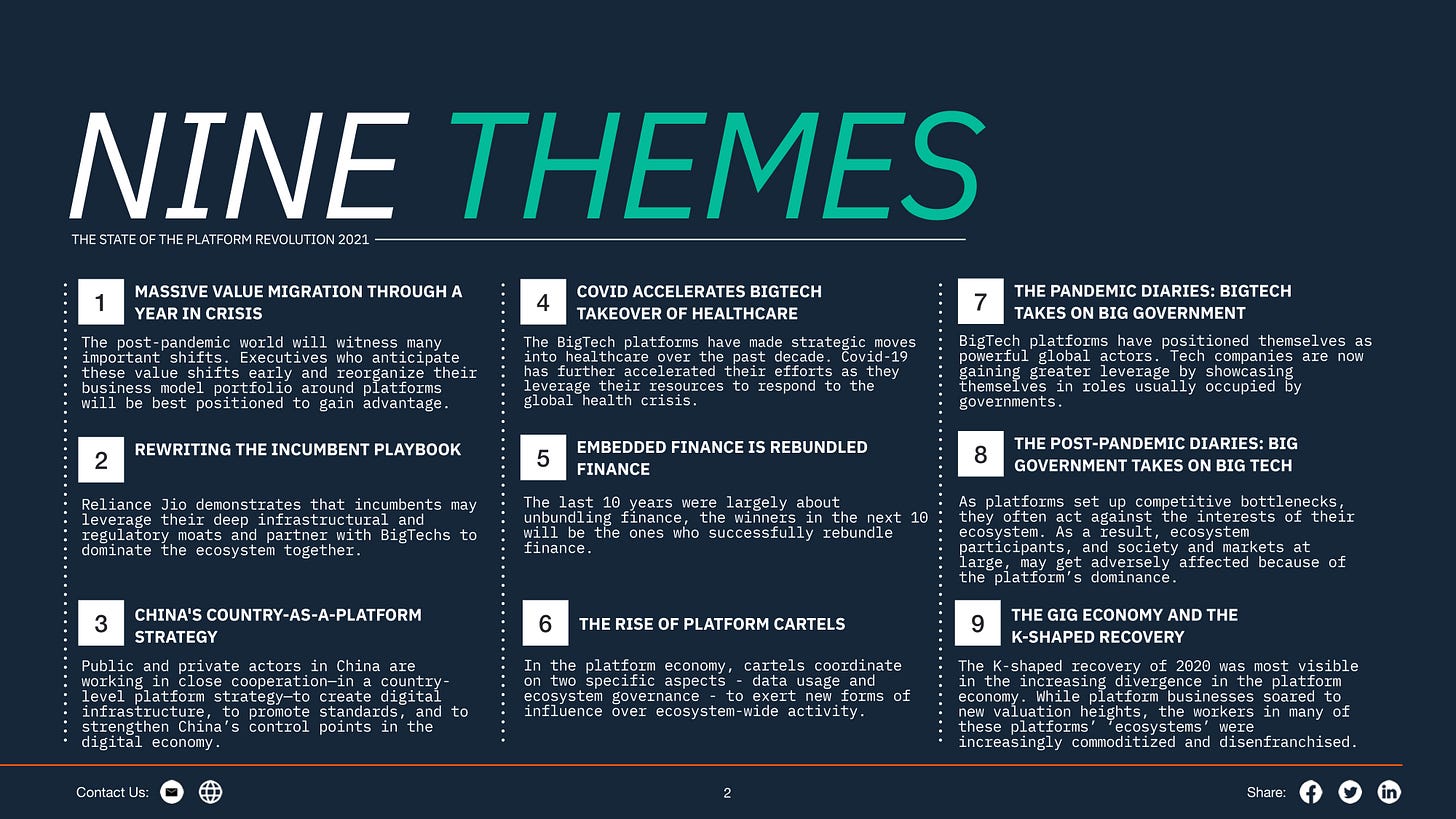

Nine big themes for 2021

For an in-depth analysis of big themes in the platform economy in 2021, get your copy of the State of the Platform Revolution 2021 report.

The report covers nine key themes that will define the platform revolution in 2021.