How to regulate Facebook and Google - Hint: NOT as platforms

The counterintuitive approach to regulating Facebook and Google

The common narrative today - and also in a lot of my work, including Platform Revolution - frames Facebook, Google, and Twitter as multi-sided platforms.

Are Facebook, Google, and Twitter multi-sided?

Absolutely.

But viewing them solely with that lens has limitations, which interferes with our efforts to design regulation.

In fact, Facebook and Google realise this all too well and plow the ‘we-are-a-neutral-platform’ line to skirt regulation.

What if we viewed Facebook and Google as pipelines, instead of platforms? Surprisingly, that gives us a rather compelling framework for regulating them.

The ideas in this post were first published as a Twitter tweetstorm.

Let’s dig in!

But first…

Regulation is one of the key themes in the State of the Platform Revolution 2021 report. Get your copy of the report.

And if you haven’t already subscribed to this newsletter, do subscribe to get early access to all our future reports and insights.

A counterintuitive view for regulators

During the course of my work advising regulators on platforms, one of the most interesting projects I’ve worked on involved applying a variety of non-platform lenses to these companies. Essentially, now that the dominant view of Facebook and Google as platforms is widely accepted, what counter-intuitive non-platform lenses could we apply to analyse these companies.

This article sets up one such lens.

Facebook and Google are really pipelines, masquerading as platforms

A lot of my work talks about the distinction between pipelines and platforms. To really determine whether a business is a pipeline or a platform, we need to start with the core value unit - the minimum unit of value created in the business.

So what really matters is the unit of analysis. What’s the minimum unit of value created on Facebook.

From a 'product management' perspective, if you claim you're ‘building for users’, the core value unit is content.

But from a 'business model' perspective (unit of value, a portion of which is captured), the core value unit is attention.

If the core value unit is attention, these companies are very much traditional pipeline businesses harvesting attention, packaging them into data and targeting products, and selling them - literally - to the highest bidder.

Attention as core value

Why is viewing attention as the core value unit important?

Because business models are built around scarce and tradable resources.

Tradability affords value transfer and scarcity affords negotiation leverage in such transfer.

Attention is both scarce and tradable.

Attention is scarce - yes, because the sum total of human attention is a finite number.

But more important, with an abundance of content and interactions, our decision-making ability gets depleted, allowing our attention to be more manipulable as a resource.

Attention is also tradable. Sophisticated auction mechanisms trade our attention (and the attendant decision - which is already manipulable) to the highest bidder.

The ‘pipeline’ hat

Hence, to regulate these companies, we really need to take off the 'platform' hat we don for product management and put on the 'pipeline' hat, viewing these companies as pipelines of attention.

Attention as an input to ‘manufacturing’ manipulable decisions and actions is the scarce and tradable resource.

With that view, Facebook and Google are running pipelines which take attention as an input towards manufacturing and delivering manipulable action as output. Mix in attention harvesting with fine-grained data and behavioural economics 'nudges' and you can influence human action at scale. And package that and sell it to the highest bidder.

If you’re enjoying this article so far, please consider sharing it further:

Attention economics and user agency

While we’re on the point of behavioural economics ‘nudges’, a further point to think about is ‘agency’. In fact, agency - whether users perform at will or are manipulated by platforms - is a big theme in most of my work on regulation (e.g. my work with the ILO’s Future of Work Commission).

Pull (search) involves some agency.

Push (e.g. news feeds, recommended videos on Youtube) involves much lower agency.

Push models can be (and are) fine-tuned to harvest attention further. Shifting the unit of analysis from content to information, our notion of production also changes.

'Producers' on these 'platforms' are producing content but the consumers of content are 'producing' attention which may be transformed, packaged, and traded at scale.

Anti-Competitive behaviour?

Another lens to figure the unit of analysis is competition.

When products are substitutes, they compete in the same market.

Arguably, an Instagram photo is not a substitute for a Whatsapp message. But the attention harvested on the two 'platforms' are arguably substitutes. Facebook acquires Instagram and Whatsapp not because it wants to increase its 'content' portfolio but because it wants to minimize competition from substitutes to its 'core product', which is attention.

Facebook often uses the term 'platform' to skirt antitrust regulation. But regulators need to take off the 'platform' hat and see these companies simply as harvesters of attention.

Moving beyond data regulation

Another issue that distracts regulation is focusing on data rather than on attention.

Eventually, what is traded is attention (and the attendant decision and action, which as mentioned earlier is manipulable). Data is merely a mechanism to manipulate that decision and action.

Regulators today regulate data as the scarce and tradable resource. Hence, regulations like GDPR focus on ownership and access of data as a scarce and tradable resource. Instead, attention and the attendant, manipulable action should be the focus of regulation.

Regulating across the AdTech Stack

Practically, this calls for new regulation of algorithmic advertising rather than regulation of data ownership and access.

Antitrust in itself is limited in regulating algorithmic advertising for a variety of reasons.

Antitrust views competition as a solution to concentration. Unless we see attention as the resource being competed for, the definition of competition and hence the regulation to address it can be obfuscated.

Second, more competition - while better than concentration - is not a sufficient response. This is because AdTech is modular and, over time, lower layers of AdTech get commoditised and standardized across the industry. This results in tacit collusion. For example, if multiple companies use the same adtech at the backend, more competition on the service frontend won't offer any solution to the problem of attention harvesting. The algorithms managing the harvesting will learn from similar datasets and converge over time even as consumer experience on the frontend diverges and increasingly competes through differentiation.

Third, regulation needs to work across the stack - from

(1) regulating frontend services which use 'dark UX patterns' to manipulate actions, to

(2) 'mid-end' ad-tech that matches attention to the highest bidder, to

(3) back-end data markets that commoditize and trade data and data derivative products

These are hard problems.

While we're far from perfect solutions, we need to at least start framing the problems right.

As a quick recap:

View attention - the scarce and tradable asset - as the unit of analysis

Understand that neither breaking up nor increasing competition will solve the problem

Shift regulation from data collection and access to attention-decision-action harvesting

Regulate across the adtech stack

If you enjoyed reading this article, please consider sharing it further.

Nine big themes for 2021

If you enjoyed reading this analysis, you should check out my in-depth analysis of big themes in the platform economy in 2021, get your copy of the State of the Platform Revolution 2021 report.

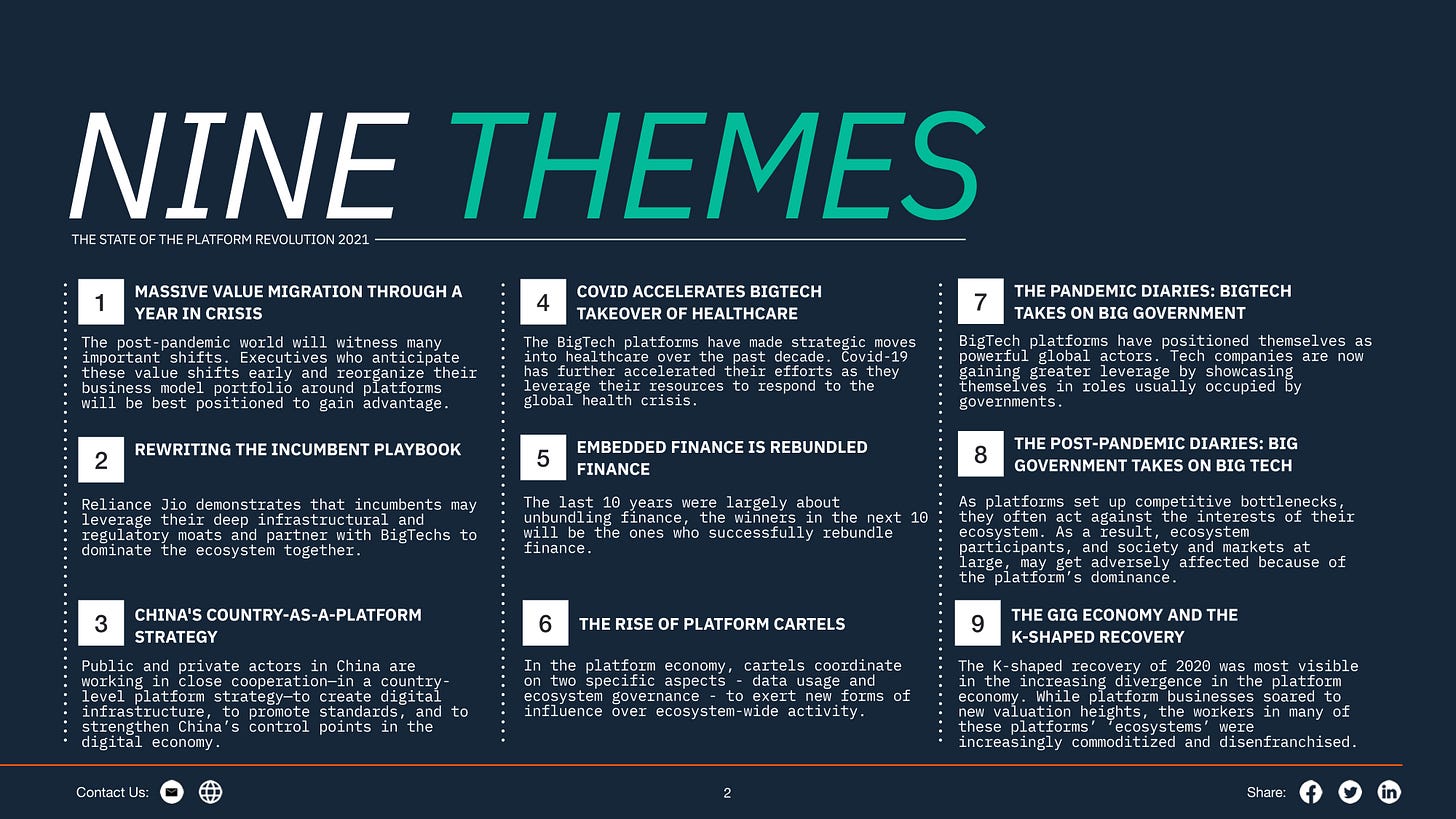

The report covers nine key themes that will define the platform revolution in 2021.