Web3 and the revenge of the long tail

How blockchain-based protocols enable niche market activity

The early promise of Web2 was built around the argument of the long tail.

Back in 2006 - the early days of Web2, when Facebook was still a dorm room phenomenon and Yahoo was making fun acquisitions in user-generated content - Chris Anderson published his NYTimes bestseller "The Long Tail", arguing that the internet would empower niches in the long tail. And that, by extension, business value would shift away from a few 'fat/short head' categories and migrate to many niches across the long tail.

That future didn't really play out as expected.

Instead, over the next 15 years, we've seen large platforms aggregate niche market activity and increasingly centralize value away from these niches.

But with the rise of blockchain-based protocols, we may finally have the necessary business architecture and economic incentives to drive value in niche market activity.

In the coming years, we'll finally see the 'revenge of the long tail'.

This essay looks at:

The long tail fallacy - what long tail proponents got wrong about Web2

How Web2 network effects exploit the long tail

Five factors that enable web3 protocols to support niche markets

Gaining early adoption in niche markets through Web3-native use cases

Role of scarcity in driving niche market activity

Role of composability and interoperability in enabling the long tail

NFT-driven niche communities

But first…

If you haven’t already subscribed to this newsletter, do subscribe to get early access to all future analysis on platforms vs protocols.

The long tail fallacy

Chris Anderson and other early Web2 pundits who heralded the rise of the long tail got half the argument right.

They figured that 'shelf space' was no longer scarce on the internet and, hence, was no longer a bottleneck. The internet allowed unlimited hosting of supply and hence could enable markets around the long tail of products.

What they failed to realize was that the internet, instead, shifts scarcity to the demand side and creates a bottleneck on the demand side. Consumer data and attention are scarce. And as I lay out through a lot of my work, the few firms - aggregators - who could aggregate and centralize consumer data aggregated all market activity.

As I elaborate in The Building Blocks Thesis, this aggregation ran counter to niche market activity:

The challenges posed by centralized platforms emerge because of:

(1) loss of context through standardization and ‘central planning’ and

(2) concentration of power through centralization.

Standardization across diverse contexts involves a trade-off; the loss of end-user context... which effectively kills runs counter to any community effects and cultural effects that niche markets benefit from.

Platforms also leverage their scale and consequent market power to increasingly commodify and disempower platform users.

This disempowerment enables platforms to increasingly extract value from the ecosystem - and particularly away from niche producers.

Finally, the factors above work together to drive concentration of an inordinate amount of wealth in the hands of a few.

How network effects exploit the long tail

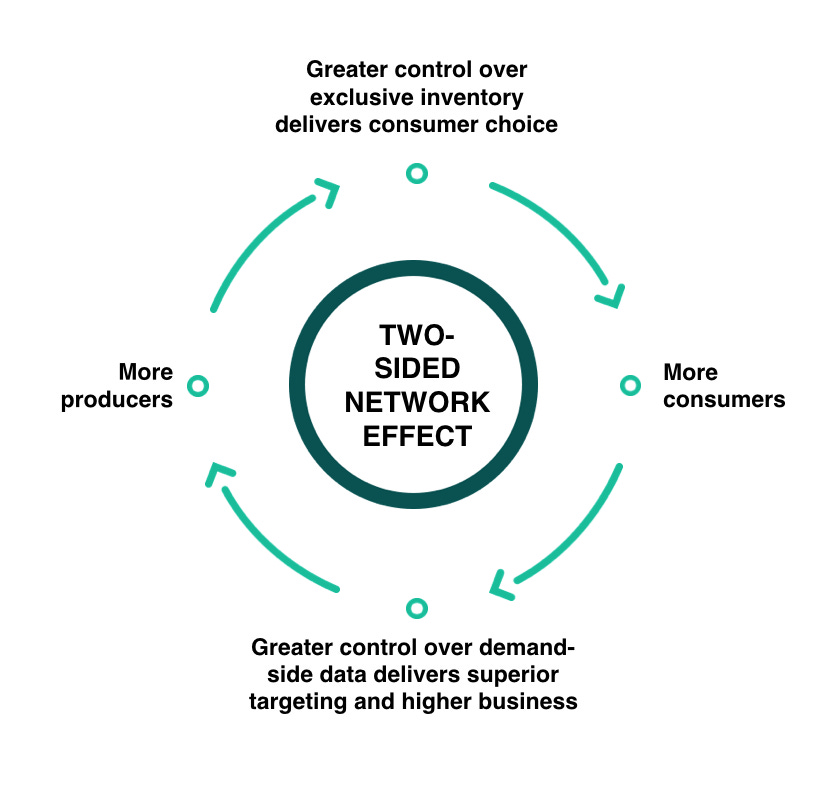

General purpose Web2 marketplaces scaled through network effects by controlling both supply-side inventory and demand-side user data.

Control over supply side inventory ensured that producers stayed on the platform. Control over demand side data ensured that consumers stayed on the platform. Both sides, then, contributed to the two-sided network effect.

As more producers participated on the platform, more consumers found value and as more consumers participated on the platform, more producers were incentivized to stay one.

This classic two-sided network effect helped scale up platforms and marketplaces.

As these platforms scaled, value created in niches increasingly accrued back to the platform.

This played out in two different ways.

First, successful niches become increasingly organically dependent on the underlying platform. If a producer succeeded in dominating a particular niche, they did so by optimizing their listing for discoverability by the platform's algorithms. Further, as their visibility and transactions increased, they gained greater reputation and hence greater visibility (think of a five star rated listing ranking higher in subsequent transactions as the platform's algorithms favoured the listing). This self-reinforcing feedback loop ensured that the niche producer remained successful within the framework of the platform and continue to pay increasing 'marketplace tax' as all transactions were funneled through the platform.

Second, platforms exert inorganic control over niches. In some cases, the platform owner may acquire a brand that succeeds in a particular niche. Worse still, in other cases, the platform owner may directly start competing in a niche after its success has been proven out by independent producers. The platform then deprioritizes listings from the niche producers and ends up dominating that niche. Amazon has infamously moved many niche brands off its platform, subsequently entering and dominating those niches through its own products. Platforms may further disempower niche producers by penalizing them for participating on other channels. Amazon's price matching algorithm is one such example.

Owing to the above factors, it becomes increasingly difficult for long tail producers to organize themselves in niche markets, driving more such activity to horizontal platforms.

Web3 protocols enable niche markets

With the rise of protocol-based market coordination, niche markets are poised to make a comeback.

There are five specific reasons why Web3 enables niche market activity.

1. Supply-side inventory is on-chain and openly accessible

On the supply side, inventory is no longer 'locked in' to specific platforms. Supply side inventory is on-chain and openly accessible. Once onboarded, all search agents can access the same on-chain inventory. Control over supply - a hallmark of web2 - is no longer a source of lock-in in Web3.

2. Demand-side consumption data is portable

Equally importantly, demand-side consumption data is portable across platforms. Web2 platforms relied on news feeds and recommendation systems to constantly engage users. Consumption data - extracted and controlled by the platform - enabled superior recommendations and personalized feeds, locking the user into the platform. With data portability, users can move their data across search agents and continue to benefit from highly personalized recommendations.

This removes user-side lock-in, again, one of the key control points for Web2 platforms.

3. Reputation data is portable on Web3

Reputation data is also portable on Web3. One of the key drivers for Airbnb's success is the fact that five-star rated hosts do not want to leave the platform as they get much higher visibility on the platform. Similarly, bookings from highly rated guests have higher acceptance, which they may not benefit from on a new platform.

Reputation data portability removes lock-in as both producers and consumers can port their reputation data into competing providers.

4. Integrations and composability allow participation across many ecosystems while engaging a specific community uniquely

Integrations and composability are additional drivers enabling the rise of niche markets in Web3. Niche markets may gain from activity across a wide range of ecosystems by being integrated across them. For instance, a niche market for trading a specific type of in-game collectible may gain adoption through integrations with many different Web3 gaming worlds.

5. Niches also coordinate through adjacent governance

Finally, niches can also coordinate activity through adjacent governance. A niche Web3 market maker may purchase governance tokens in another niche if there is substantial overlap in user base. This allows the two niche markets to coordinate their evolution and roadmap while serving similar user bases.

If you’re loving it so far, do share this further.

Agent-based architecture

As I shared in Unbundling the unbundlers,

The market governance embedded at the protocol layer enables market infrastructure components to be unbundled to their most basic units.

For instance, a marketplace like Ebay bundles seller onboarding, seller analytics, buyer onboarding, buyer decision support, search functionalities, and exchange infrastructure. All these components will be unbundled in a Web3 world.

As a result, we move away from central market-maker architectures to decentralized agent-based architectures, all coordinated by a shared, common protocol.

These agent-based architectures enable the creation of niche marketplaces with niche-specific user journeys, all supported by a common protocol.

While Web2 marketplaces like Ebay scale horizontally across niches, it is increasingly likely that horizontal Web3 marketplaces like OpenSea will be confronted with growing competition from stand-alone NFT storefronts.

To win niches, go Web3-native

Contrary to what many Web3 enthusiasts preach, marketplace activity does not migrate away from centralized platforms just because decentralized alternatives are created.

For protocol-based niche marketplaces, building activity will require catering to Web3-native use cases first - use cases that cannot currently be solved in Web2.

For instance, while Boson Protocol (I’m an advisor) aims to be the general purpose decentralized commerce protocol, it has gained most of its initial adoption by serving as an enabler of metaverse commerce, enabling brands to participate in the metaverse. In similar fashion, any protocol looking to support niche market activity should look to gain early adoption with Web3 native use cases before moving into broader use cases currently supported by Web2 platforms.

Below, we look at three specific web3-native use cases, driven by Web3-native value propositions:

Scarcity

Interoperability and composability

Asset ownership

Before we dive into specific examples, consider sharing this further.

Building communities around scarce assets

Web2 platforms like Facebook and Twitter support social interactions horizontally. Web3 protocols could enable niche social networks and community activity that are uniquely enabled by blockchain.

Consider Decentraland, where digital land as a scarce asset forms the basis of engagement.

Any niche market activity around scarce collectibles, represented as NFTs (e.g. BAYC), could also gain early adoption through protocol-based niche networks.

The in-game digital goods economy provides another social space where niche communities organize around digital assets and would value scarcity (The Axie Infinity debacle notwithstanding).

Instead of competing directly with horizontal Web2 platforms, niche Web3 networks and markets should look to piggyback Web2 platform activity. Apps like Zynga piggybacked Facebook a decade back to gain adoption. If Meta’s play as a social layer for the metaverse works out, it would provide similar piggybacking mechanics for the rise of niche Web3 networks.

Twitter also arguably is emerging as a layer that niche Web3 networks can piggyback. Finally, social networks like Snapchat, which enable augmented reality filters, could also serve as an underlying network on which niche communities find initial adoption.

I believe the best niche market strategies will need to embrace the best of what Web2 and Web3 have to offer:

Web3 protocols to deliver Web3-native use cases

Web2 platform integrations to drive initial adoption

Composable innovation across shared resources

Blockchains enable another unique form of ‘Web3-native’ innovation; the ability to create interoperable applications that work off a shared, public database.

An open database allows creation of global inventory that can then be queried across a range of different applications. This is particularly useful for niches that demand highly specific functionality and are woefully underserved by horizontal platforms.

Public, shared inventory may appear across various user contexts, queried by different recommendation engines and search agents, further allowing a niche-specific user journey to be constructed across a range of such interoperable applications. Composability further allows developers to innovate on top of modules that already exist and create further niche-specific experiences.

NFT-enabled niche community activity

Finally, NFTs enable niche markets in ways that would not have been possible in Web2.

Access NFTs may be used to enable invite-only access to members of niche communities and may hold shared rights on assets valued by the community. Niches, particularly those where a sense of belonging is associated with asset ownership (e.g. unique works of art, music, and other cultural artefacts) are best suited for Web3-native use cases.

As laid out above, blockchain-based protocols provide the mechanics to enable a wide range of niche networks, markets, and communities served around a core protocol. However, niche market activity will gain traction more easily with Web3 native use cases rather than in direct competition to Web2 platforms.

For all the benefits of todays platforms, long tail markets and niche communities remain underserved on horizontal platforms.

Serving these at scale may well be the true unexplored opportunity for Web3.

This is part of a series of articles included in our recently launched Web3 Builders Playbook.

Click the button below to get access to the fully illustrated playbook:

A great post again, many retailers are struggling against Amazon, but as Shopify has proven, there is a success strategy in a retail niche that can be capitalized on. Thanks for sharing!

Google’s obscene use of Penguin and Panda in 2012 killed off a lot of these niche businesses like mine that we’re started with a strong belief in the “Long tail”. Nice article. I hope you are right about Web 3.0