How stand-up comedy helps Amazon win at e-commerce

On Attention Conglomerates and Internal Attention Markets

Amazon Prime Video has powered the rise of stand-up comedy in India. Why does Amazon care about stand-up comedy and how does this tie in with its e-commerce ambitions?

Comedy, as we’ll note shortly, is a critical lever to improving Amazon’s economics on e-commerce.

Let’s dig into this one!

But first, get a copy of the 2024 Tech Strategy Toolkit launched last week:

The Attention Conglomerate

Industrial economy conglomerates brought together multiple, different, independent businesses for diversification, capital efficiency and cross-leverage.

The key input organizing these conglomerates was capital.

Attention economy conglomerates bring together diverse - seemingly unconnected - businesses to gain scale, efficiency, and cross-leverage in managing and harnessing user attention.

The key input organizing these conglomerates is attention (and data harvested as a consequence).

We’ve got many good examples of industrial economy conglomerates. What’s a good example of an attention conglomerate?

The Attention Premium of Amazon Prime

In Why offline retailers fail at online marketplaces, I explained the role that Amazon Prime plays in the Amazon ecosystem.

Amazon runs the world’s most successful membership program. It’s called Amazon Prime. Prime users spend much higher than regular users.

Prime is uniquely defensible for three reasons:

Offering 2-day delivery is non-trivial. It requires a warehousing footprint informed by data on where users are shopping from.

Prime delivers high-margin profit to the balance sheet (in the form of membership fees), all of which is reinvested in expanding the warehousing footprint. This creates a virtuous cycle.

Prime’s value constantly increases as a bundle. It is no longer simply about 2-day deliveries. It also bundles movies and music. JP Morgan estimates that the value users get from Amazon Prime is worth at least 6 times what it costs.

Prime is Amazon’s attention factory where Amazon harnesses attention and converts it into value through its marketplace.

How Amazon values attention as an input is entirely determined by how Amazon converts it into business value as an output.

The average Amazon customer spends about $600 annually on the site, while the average Prime member spends $1400.

Prime delivers an attention premium into Amazon’s e-commerce business.

Amazon and Netflix are in fundamentally different businesses, despite having similar products and despite competing for the same customers.

"When we win a Golden Globe, it helps us sell more shoes" - Jeff Bezos

Unlike Netflix, Amazon is an attention conglomerate.

It harvests attention from multiple sources (Ecommerce, Video, Ebooks etc.) and invests that attention in multiple destinations (Ecommerce, Video, Ebooks etc.).

Internal attention markets

Industrial-era conglomerates relied on internal capital markets, creating cash flow through one business and investing it into another. These internal capital markets allowed them to share resources and finances across businesses, share costs, and improve capital efficiency.

Amazon is an attention conglomerate. It creates an internal attention market, acquiring attention through one business and converting it into value through another.

One of the primary modes of generating attention for these ‘internal attention markets’ at Amazon is Amazon Originals.

Leaked internal documents reveal that Prime Originals - shows created exclusively by and for Amazon Prime Video - account for as much as 25% of total Prime sign-ups.

In Amazon’s internal attention market, Prime Video is a strategic point of attention acquisition. By harnessing attention into the Amazon conglomerate, it plays a role similar to a cash-flow generating business in an industrial conglomerate.

Come for the video, stay for the commerce

This is a crucial insight. A lot of industry analysts see Prime Video as a retention mechanism. Their interpretation of Amazon Prime is:

Come for the commerce, stay for the video.

This line of reasoning suggests that users primarily sign up for Prime to get two-day delivery. Video is just one of many things that sweetens the deal.

But if you look at Amazon as an attention conglomerate, the reality is not quite as straightforward. Amazon’s strategy is, in equal parts, or perhaps more so:

Come for the video, stay for the commerce.

Video is a key acquisition point. And one which delivers the lowest CAC.

In a way, this it the digital counterpart of the offline mall strategy - come for the multiplex, stay for the shopping.

Cost-per-first-stream: The logic of a loss-making movie studio

Prime Video is strategic to Amazon’s internal attention market in churn reduction as well. As Bezos himself claimed, film and TV customers renew their Prime subscriptions "at higher rates, and they convert from free trials at higher rates" than members who do not stream videos on Prime.

This begs the question - Is audience acquisition through Prime strategic or incidental?

Does Amazon actually view Prime Video as a critical part of an internal attention market or is it merely looking to create a better product than Netflix?

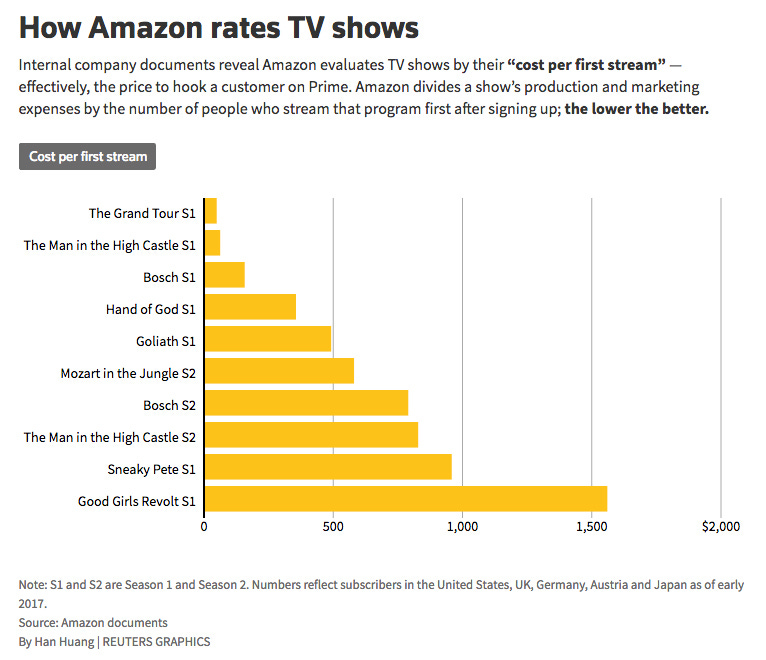

The answer to this lies in a metric designed by Amazon called "cost per first stream". Amazon rates TV shows internally based on the cost per first stream.

A specific show is attributed a ‘first stream’ if it attracts a user to either start or extend a Prime subscription and if that show is the first one a user streams after performing these actions.

The ‘cost per first stream’, then, is the cost of producing and marketing the first season of that show divided by the number of ‘first streams’.

That cost-per-first-stream is Amazon’s customer acquisition cost into Prime.

Amazon’s attention-management portfolio

Vertically integrating into movie production isn’t just about cost advantages and production control. It’s also about creating shows that can deliver progressively better cost-per-first-stream, especially in new markets that Amazon gets into.

In the graph above, The Grand Tour has the lowest cost-per-first-stream. This is despite Jeff Bezos’ own admission that getting the Grand Tour together was "very, very expensive". According to Reuters, The Grand Tour garnered 1.5M "first streams" but the hefty upfront cost is still a significant risk.

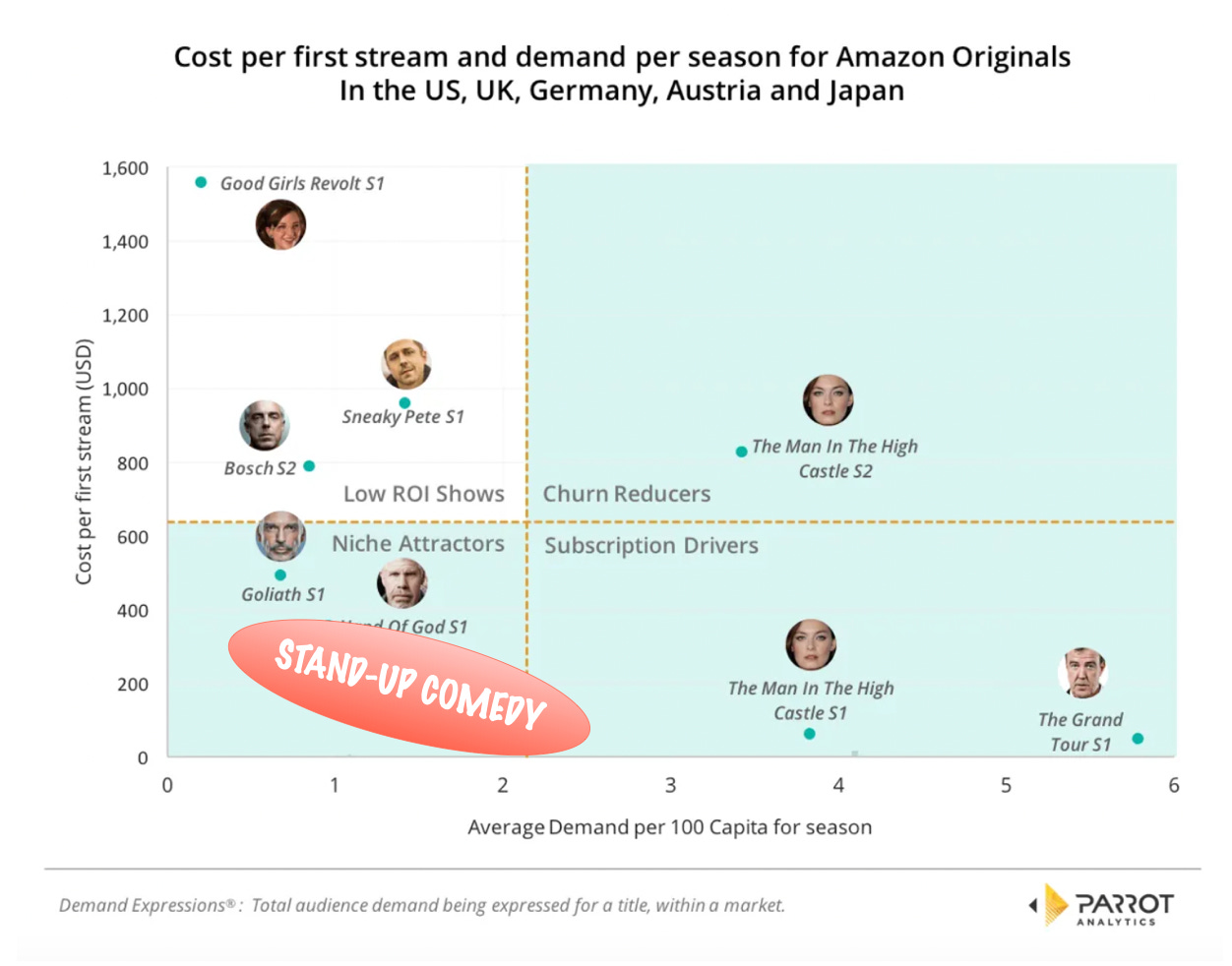

This risk works out when the show is a significant subscription driver. In fact, the categorization by Parrot Analytics below explains the role that different shows play in Amazon Video’s attention-management portfolio. Amazon’s shows perform various roles in this portfolio - some drive mass subscriptions, some help with user retention, and some help attract niche audiences.

Source: Parrot Analytics

You’ll note that The Grand Tour, at the lowest cost-per-first-stream is also a show whose first season was in huge demand. As was The Man In The High Castle.

What’s interesting, though, is that The Man In The High Castle S2 continued to play an important role in retaining users. On the other hand, Goliath and Hand of God - with low cost of first stream, but also relatively lower demand - helped acquire niche audiences. Better still, unlike The Grand Tour, these shows didn’t carry the risk of a heavy upfront investment.

This is where customer LTV starts playing a role as well. Shows that attract niche audiences will likely be renewed for subsequent seasons if the Prime customers they bring on board also have (or demonstrate behavior that predicts) higher LTV.

Why Amazon kickstarted a stand-up comedy revolution in India

This brings us to Amazon’s love affair with stand-up comedy in India. A Prime special has become a rite-of-passage of sorts for stand-up comics in India.

Amazon’s foray into stand-up comedy fits into the bottom-left quadrant.

The cost of acquiring new content is incredibly low, particularly from comics who are just about to break out and see Amazon as a breakout channel. Unlike films, comedy comes with a lower price tag making the cost-per-first-stream work out in Amazon’s favour. Moreover, by positioning itself as a comedy hub, Amazon retains a section of its user base effectively without commensurate investment in content.

Prior to Amazon, stand-up comics had few paths to gaining widespread consumer attention in India. Comedy breakouts on YouTube in the early 2010s were the exception rather than the norm. Post-Amazon, comedy clubs have mushroomed across the country. More than 10% of Amazon Prime members now watch stand-up.

As the audience for stand-up comedy increases, the entire ecosystem around it grows. And Amazon Video positions itself firmly at the centre of this ecosystem as a curator of the best stand-up comedy shows from up-and-coming talent.

The business behind the business

It’s always important to keep an eye on the real business - the business behind the business.

Amazon wants India to be a nation that devours stand-up comedy. Because it delivers possibly the lowest CAC at which Prime members can enter its e-commerce empire.