Pipelines to platforms to protocols: Reconfiguring value and redesigning markets

What if the real shift is much larger than just a shift from Web1 to Web2 to Web3

From the compass to the printing press, steam engine to electric lightbulb, economic history shows that whenever technology disrupts the market forces of production and consumption, value creation will change in step. The level to which individual players benefit from these technological gains is then dictated by the degree of market power they wield.

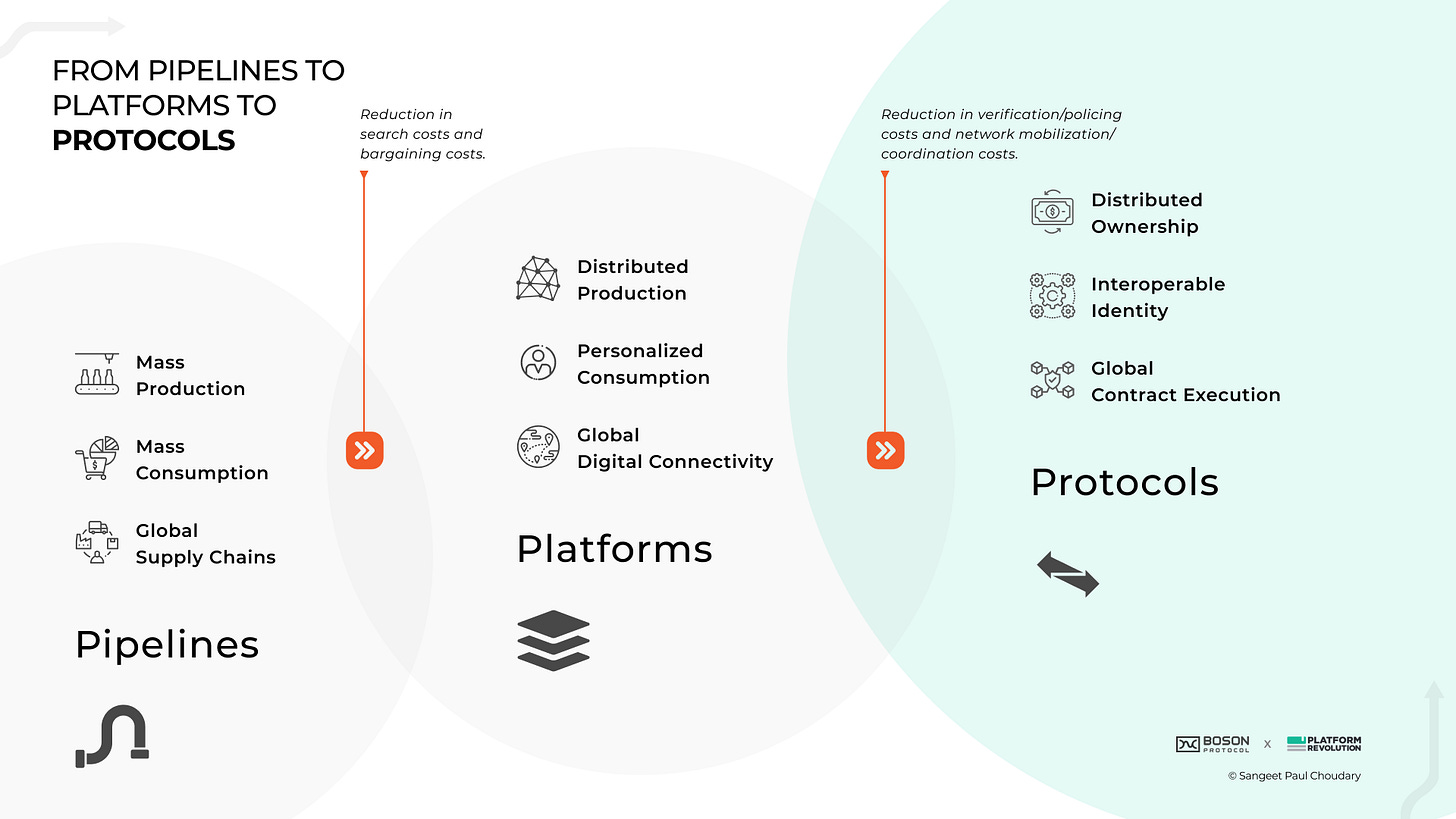

Over the past decade, my work has focused on the shift from pipelines to platforms as a transformative shift in value creation that shaped the first two decades of the twenty-first century. I believe that the shift from pipelines to platforms, now widely accepted, will shift further with the emergence of protocols as the foundational technology of Web3.

This, I believe, is the real shift of our time - a fundamental redesign in value creation and markets, not just a shift towards decentralisation or read/write/own, as many of the Web1 to Web2 to Web3 proponents often claim.

This article explains why this transition matters and is increasingly inevitable.

But first…

The rise of pipelines

Value creation in the industrial era was dominated by pipelines. Pipelines are the traditional industrial business model, characterised by a linear, unidirectional flow of value from producer to consumer, where value is created by the producer and shipped out to the customer, who then pays for the value. And it was the technology of the industrial era that shaped the pipeline model of value creation throughout much of the 20th Century. First, technologies enabling mass production — assembly lines optimized through factory automation, backed by large-scale, organisation management — allowed us to aggregate production at scale. Together, these gave us the tools of mass production and gave birth to large corporations, particularly during the post-World-War geopolitical shift towards globalisation.

On the consumption side, the rise of mass media — from newspapers to radio and then television — provided the means for influencing consumption at scale, like never before. The rise of cities and suburban populations provided the market conditions for mass consumption to meet mass production through retail, forcing prices down and improving choice and convenience.

Finally, the shift to globalization and international trade, spurred further by standardization technologies, particularly container shipping, led to the creation of global supply chains, connecting mass production with mass consumption globally.

By perfecting the technologies of mass production, mass consumption, and global connectivity, the industrial era perfected its ability to scale value creation through the pipeline model and benefit from supply-side economies of scale.

The shift to platforms

Throughout history, technological shifts and market forces have worked together to drive new paradigms for value creation. With the rise of the internet and of digital technologies, this combination of technological changes and market forces drove the shift from pipelines to platforms.

First, the tools of production could now be distributed, rather than centralised. Consider the news industry as an example. To create and distribute news at scale, you had to be a large newspaper company. But then the internet decentralised the tools of publishing and distribution, so that anybody with access to wiki or web authoring tools could produce and disseminate news.

Second, the capture of data at scale — for instance, through social technologies and subsequently through connected devices — combined with improvements in machine learning and artificial intelligence drove the rise of personalized consumption.

As markets shifted from mass production and mass consumption to distributed production and personalized consumption, the internet provided a global connectivity infrastructure to connect the two. Mobile-based connectivity and cloud computing enabled the creation of a new alternative for global value exchange. Cloud hosting connected distributed production to personalized consumption through a global network. Together, these three technologies drove the rise of platforms as the dominant model of value creation. Platforms connected producers and consumers with each other allowing them to create an exchange value and facilitating these interactions at scale. By adding more and more producers to these platforms, there was more choice for consumers, enabling these platforms to benefit from demand-side economies of scale.

Platforms rearchitected value creation away from ‘mass production connected to mass consumption’ to ‘distributed production connected to personalised consumption’. By aggregating fragmented markets, platforms reduced search costs — the costs incurred in counterparty discovery. By standardizing transactions at scale, platforms reduced bargaining costs — the costs incurred in negotiating the terms of exchange. And by acting as central intermediaries with market-wide data capture and visibility, platforms reduced verification and policing costs — the costs incurred in imputing trust to transactions by verifying and policing those transactions.

In achieving the above, platforms created massive value while also gaining inordinate market power. Demand-side economies of scale — manifested through network effects and learning effects — coalesced entire markets around a few dominant platforms.

We’re just warming up before we dive into the implications of this shift.

If you’re loving this so far, do consider sharing it further:

The resurgence of protocols

Protocols — more specifically, permissionless blockchain protocols — provide a new organizing and governance mechanism to organize actors in an ecosystem. Unlike platforms, protocols do not provide end-to-end market infrastructure nor do they internalize transaction policing and verification. Since protocols do not themselves provision market infrastructure or internalize transaction policing and verification, they need to set up the economic incentives for other ecosystem actors to provision these services. They achieve this by issuing tokens to reward desirable actions in the ecosystem. As the value of market activity in the ecosystem increases, the value of the token — tied to protocol usage — increases as well. As an example, Boson Protocol leverages commitment tokens to secure commitment of buyers and sellers to a transaction, thereby externalizing verification of the certainty of the transaction.

Just as there was a fundamental shift in value configuration from pipeline to platforms, so production, consumption, and markets are poised to transform again with the shift from platforms to protocols. Protocols have often been dismissed by Web3 skeptics, as hacker tools that will only impact a small community. Instead, protocols — in combination with tokens — look increasingly likely to power the next generation of market economics.

First, protocols (in combination with tokens) change the incentives and returns on production. The platform economy has often been criticized for skewing rewards away from external producers, who commit resources to the platform and incur risks, and centralizing rewards with the central platform organization. Token rewards provide an alternate incentive mechanism where ecosystem producers are incentivized for desirable actions that grow market activity. These tokens, in turn, grow in value as overall market activity increases, enabling external producers to benefit from returns.

In addition to improving returns on production, protocols — particularly, through non-fungible tokens (NFTs) — also empower producers by establishing, transfering, and enforcing property rights over the assets they produce. Well-structured token incentives combined with the verifiability of asset ownership skew rewards of production back to the producer.

On the consumption side, protocols disentangle consumers from the lock-in enforced by platforms. Platforms drove market efficiencies by leveraging data to reduce search costs and verification costs. This involved an inherent trade-off as market participants — particularly consumers — needed to surrender their data to the platform to benefit from these market efficiencies. This surrender of data and attendant lock-in increased the risks of privacy invasion, loss of agency through over-dependance, and unilateral censorship as centralized platforms could change their policies at will.

Blockchain protocols reduce transaction verification costs without absorbing these costs as intermediaries and, instead, allowing market actors to verify transactions and enforce contracts, while preserving data privacy. Since identity and data no longer need to be locked-in to a platform to verify and impute trust to transactions, consumer identity now becomes interoperable and consumers can participate across multiple platforms and protocols, while retaining custodianship over their identity.

In my work as an advisor to Boson Protocol, for instance, I’ve advocated an approach of unbundling market infrastructure from governance, which allows buyers to manage their identity and interoperate across different buy-side applications when interfacing with the protocol. This again reduces lock-in for the buyer.

Protocols bring decentralised ownership, giving creators greater control over what they’re creating. Alongside distributed production and market access on your own terms, you will now have the property rights to leverage as you choose. Production can be scaled up even further, especially in markets where ownership of intellectual property is valuable to the creator.

With protocols, property rights go back to the creator and identity goes back to the consumer. But much like pipelines needed standards in global supply chains and platforms needed a global compute infrastructure, protocols require a new operating infrastructure to manage decentralized transaction execution at scale. Global contract execution therefore becomes very important. The rise of blockchain and distributed ledgers provides a shared view of the history of transactions: who owns what and when. Smart contracts give a shared infrastructure for executing these at scale. Again, technology brings changes in production and consumption together, creating a new mechanism for managing market activity.

What’s next

While it’s now undisputed that there was a significant shift from pipelines to platforms, I believe we are now in the early innings of a similar shift from platforms to protocols. Much like the arrival of platforms didn’t signal the end of pipelines, the emergence of protocols will not end the era of platforms. Instead, pipelines, platforms, and protocols, will co-exist as different mechanisms to organize and configure value in the economy. Some parts of the economy will be best managed through platforms, while other use cases will lend themselves to decentralized protocol-based management.

In the last two years, we have seen a number of tipping points that will herald the arrival of protocols. Two factors, in particular, the need for interoperability and the attractiveness of new reward sharing mechanisms, will be key determiners of the speed of this shift. Decentralised finance and the rise of tokens now provide the financial machinery for new reward sharing mechanisms. Similarly, the need for greater interoperability in the design of virtual worlds is another factor that could spur the adoption of protocols.

Finally, for all the talk about decentralization, this shift is less about equity and more about value.

We will undoubtedly see the major platforms, with their advantage of scale, leverage this new set of technologies in a way that best reinforces their current economics. Facebook (now Meta), after experimenting with Libra, is now investing heavily in protocols more broadly. It would be naive to assume that protocols themselves will also not attract new modes of value capture and control.

We’re still in the early innings of a massive shift. One thing remains certain — the new value will be created, configured, and captured differently from the old.

Business models of Web3

A lot’s been written about the technology of Web3. Relatively little is understood about the business models of Web3. Watch this space - lots more coming this year on how Web3 will really change business.

And if you’re working on a Web3 project that’s bringing this shift to life, let’s connect and discuss further. Just hit Reply.

pipeline model; benefit from supply-side economies of scale

platform model; benefit from demand-side economies of scale

what is the equivalent for protocol model, if any?

The contrast between platforms and protocols is similar to the one between proprietary tech and other general web standards like RSS. This article by Michael Mignano about "The Standards Innovation Paradox" https://every.to/p/the-standards-innovation-paradox seems relevant.