Enterprise super-apps in the age of Gen AI

The quest for the one interface to rule them all

Super-apps are all the rage in the consumer world where there’s an app for everything.

Yet, most super-apps fail.

Last year, I wrote an analysis of why most companies are not well-positioned to build super-apps. Ever since, five different business conglomerates have called me in to have a look at their B2C super-app strategy. Everyone wants to build the winning interface where users spend all their time.

The quest for the super-app is essentially the quest for the winning interface.

And now, with Gen AI, that quest is gaining steam on the enterprise side.

With Gen AI co-pilots coming in, many firms are looking to create the one interface that integrates across the complex enterprise software landscape.

The quest for the enterprise super-app is heating up.

But is this yet another hype-driven promise that goes bust? Or will we actually see winners emerging that successfully rebundle across the enterprise application landscape?

Let’s dive in!

If you’re reading this for the first time, now’s a good time to sign up.

The problem - Fragmentation in the enterprise

Since the rise of cloud-hosted applications, we’ve seen an explosion of software and tools. It is far easier than ever to set up a software (Software-as-a-service) business, but increasingly more difficult to get it to scale.

As a result, we’ve ended up in a landscape with massive tool fragmentation. Every use case is hotly contested.

This tool fragmentation leads to a second issue - data fragmentation. It’s difficult to create a single view of the customer when every part of the customer journey is served by a different tool.

Worse still, cloud-hosted software also makes tools highly substitutable. Since every tool is an API call or a login away and no longer involves long sales cycles and complex workflow lock-ins, tools are replaced way more often than was the case with enterprise software. Tool substitutability further complicates this landscape. Every time a tool is substituted, the data fragmentation problem - if there were efforts underway to solve it - needs to be solved afresh.

You may balk at the idea of the enterprise super-app but every major software company today is looking to solve this problem of tool fragmentation and data fragmentation. Users themselves would prefer to have a single interface backed by a brain that knows everything about everything in the enterprise.

That is the quest for the enterprise super-app - a quest to solve this fragmentation issue. Once solved, it delivers massive productivity gains for users while capturing ecosystem-wide profits for the player that successfully solves it.

Three shots at the enterprise super-app

Over time, there have been many efforts to address this issue.

Companies like Salesforce and Workday initially attacked this problem by trying to acquire all complementary tools that their customers might need. Only to realize that customers don’t care about up-sells, they care about the best-in-class tool for every use case. They would prefer to live with tool fragmentation as long as every function within the org had the best tool needed to deliver its own requirements.

The rise of customer data platforms provided an opportunity to solve the data fragmentation issue. Salesforce even created its own customer data platform to make its application suite interoperable. Only to realize that customers didn’t care about its application suite and would rather purchase CRM from Salesforce and other applications from other vendors and stitch them together at their end using a third party customer data platform.

Salesforce eventually decided that one way to solve this problem was to deliver the benefits of integrated data into a cohesive interface. With that, it acquired Tableau to create a layer on top of the fragmented application landscape.

None of these efforts have really delivered on the promise that they carried. Several billion dollars of investment have accompanied each effort.

Yet the quest for the enterprise super-app - the quest for the primary interface - remains elusive.

As I write in Why your super-app strategy will (most likely) fail,

You don’t get to be a super-app just because you have a lot of users on your core app and you now decide to bundle multiple services into the same interface.

You gain the right to be a super-app by

(1) gaining the primary right to customer relationship in a certain category (or in very rare cases, across categories), and

(2) gaining the right to mediate all other services (in that category) through your interface.

To understand why super-app efforts fail, let’s look at how this has played out with consumer super-apps.

Primary demand in the enterprise

In Why your super-app strategy will (most likely) fail, I explain the two key requirements for success with a super-app:

Gaining primacy of the user relationship

Owning a key control point in the application ecosystem

On the first count - gaining primacy of the user relationship - we need to start by distinguishing between primary and secondary demand:

A homebuyer has primary demand for a house. This primary demand generates secondary demand for mortgage.

In healthcare, the primary demand for cure and wellness creates secondary demand for pills and procedures.

The secondary demand is a means to an end, the primary demand is the end.

The firms that own primary demand will eventually commoditize the ones that own secondary demand.

To be successful as a super app, you need primacy of user relationship and that is best owned by owning a core use case in the primary demand.

This brings us back to the enterprise context.

Software is secondary demand for enterprise users.

The primary demand is for decision support and workflow productivity.

Enterprise users need to make decisions on the basis of information, and progress their workflows on the basis of those decisions. This constitutes their primary demand.

The primary demand for decision support and workflow productivity creates the secondary demand for software.

One of the challenges with previous efforts at enterprise tool integration is that they’ve been focused on increasing interoperability of software rather than on delivering superior decisions and workflows. In many ways, these players have continued to operate in the secondary demand.

In working with leading SAAS providers over the past year on their AI strategy, I’ve seen one common theme emerge every time -

Does Gen AI give us a right to own the interface across the enterprise application landscape?

Generative AI now holds the promise for solving the primary demand problem.

Like previous generations of efforts, it’s still a promise. But it’s worth evaluating Gen AI’s claim at finally (possibly) creating the enterprise super-app.

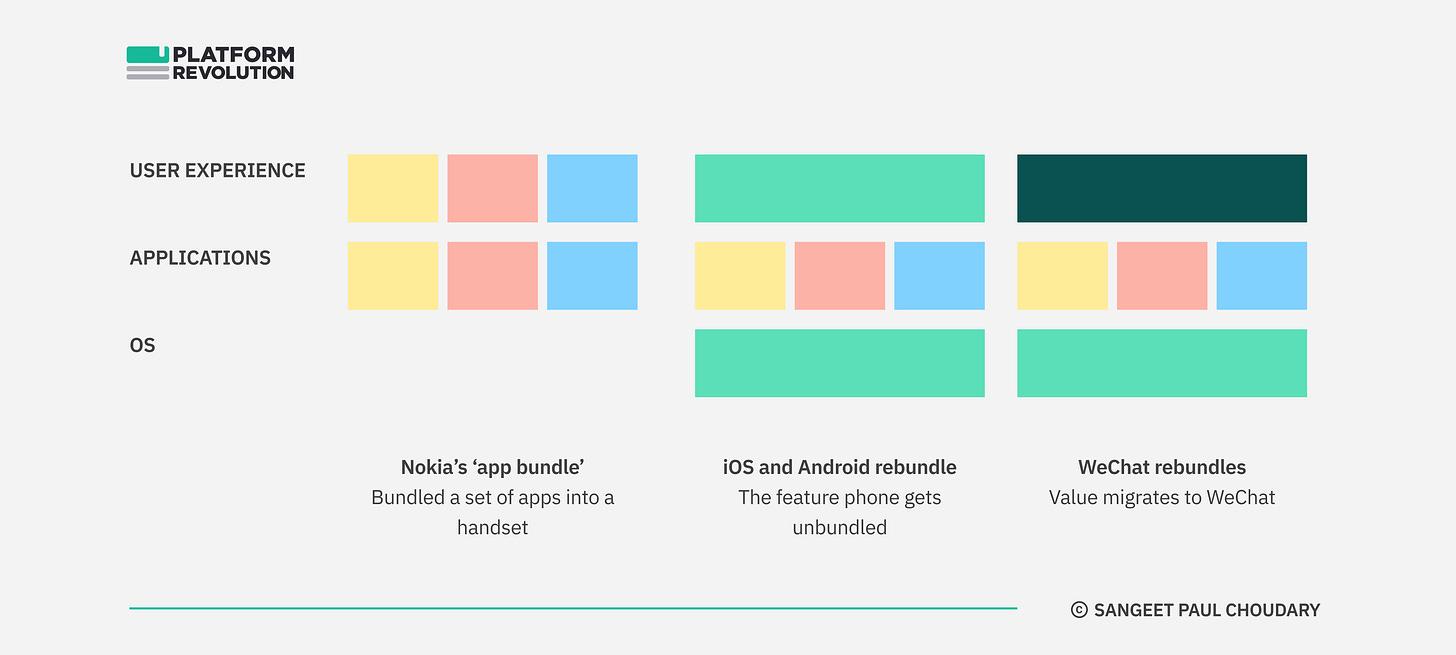

Rebundling the consumer application ecosystem

The end goal for a super-app play involves rebundling the overall app ecosystem. That is what WeChat did to eventually gain primacy of user relationship across the entire application ecosystem.

In order to do this, it had to unbundle previous app bundles and rebundle them in a new interface.

As I explain in How to win at Generative AI:

Back in the days of featurephones, Nokia bundled different combinations of apps to create a phone and then took a portfolio of such ‘app bundle’ phones to market.

The following year, Apple launched the iPhone - and subsequently the App Store - and unbundled this ‘phone-based app bundle’ and rebundled apps through the OS and App Store. You could buy a one-size-fits-all iPhone and create your own ‘app bundle’ to suit your specific needs.

iOS and Android established themselves as the new purveyors of bundling.

iOS and Android served as the performance bottleneck for a lot of mobile apps. With every update to the underlying OS, the performance of the apps could be improved and extended.

WeChat flipped this unbundling-rebundling playbook in China.

WeChat started as an individual app with vertical advantage in gaming and communication. However, it moved on to use its dominance in communication to establish primacy of user relationship as the default communication channel. It then integrated communication with payments to control the two most important horizontal capabilities that allowed it to establish a new layer on top of the underlying OS.

Users spent most of their time inside WeChat. This enabled WeChat to rebundle the apps at a layer above the OS layer. Apps for e-commerce, gaming, media etc. could now sit inside WeChat. Users never left the WeChat workflow because of its all-in-one connective workflow of communication and payments across apps.

At one point, WeChat had such primacy of the user relationship that new OS updates from Apple and Google had no impact on the user experience unless WeChat implemented those updates into its UX.

Rebundling enables value to migrate to another part of the value chain.

WeChat is a case study in value migration where a player at another position in the value chain rebundles so successfully that previous leaders (Apple, Google) become effectively commoditized.

As long as users were running their apps within WeChat, the UX on an Apple phone wasn’t all that different from the UX on an Android phone.

The right to rebundle had migrated from the OS and App Store layers to the communication and payments layer managed by WeChat.

Generative AI carries the promise of similar rebundling and value migration in the enterprise application ecosystem.

Control points in the enterprise application landscape

WeChat gained the right to rebundle by integrating across two key control points: communication and payments. This gave it the right to rebundle across applications.

In the enterprise application landscape, you gain the right to play in the primary demand (decisions and workflows) if you own:

The enterprise knowledge and context

A hub into which other applications want to connect

To rebundle across enterprise applications, an enterprise application provider needs:

ACCESS TO CONTEXT:

Access to the enterprise knowledge graph where enterprise knowledge (entities and relationships) are encoded

A vertically fine-tuned model, if pursuing a vertical industry use case

A CENTRAL HUB:

Tooling for other applications to connect and gain benefits of the AI model

RIGHT TO ABSORB DECISIONS AND WORKFLOWS:

An assistant or co-pilot to serve as the interface where most decisions are informed

Agentic capabilities to trigger and automate workflows

As we’ll note below, software providers are increasingly looking to capture the five capabilities above and take a shot at the enterprise super-app.

How does your competitive positioning change with Gen AI? Work with us to figure out!

Gen AI and the enterprise super-app - A framework

In Why your super-app strategy will (most likely) fail, I propose a framework to map out various attempts at building super-apps.

In the consumer context, these efforts map out as follows:

The ‘OG’ super-app play: Plays in the primary demand across verticals. The only credible example is WeChat.

The Local Lords: Plays in the primary demand within a vertical. Ride-hailing players like Grab in South-East Asia and Careem in the Middle East expanding into other local categories are examples here.

Embedded without cause: Plays in the secondary demand across verticals. Fintech players like PayPal and Square are good examples here. They are horizontal but don’t command primacy of customer relationship.

Graveyard of Wannabes: If you are neither horizontal nor do you play in the primary demand, you’re not really positioned to be a super-app.

How does this play out in the enterprise context?

The ‘OG’ super-app play: Plays in the primary demand across verticals.

The BigTech are vying for this spot. Microsoft, Amazon, and - to a lesser but as important extent - Google, are sharpening their axes to play here.

Over the past decade, they’ve invested in enterprise graph capabilities, Microsoft with Microsoft Graph and Amazon with Amazon Bedrock Knowledgebase.

Their cloud plays also make this very lucrative. The more AI workloads they can attract, the more they can turn on their engines on cloud revenue. This can also help them subsidize price per token for models as they can make up that revenue through increased control across the application landscape and growth in cloud revenues, which they already do very well.

A less visible candidate to win here is ServiceNow, owing to its roots in developing a workflow engine and expanding across the enterprise along workflows. In many ways, ServiceNow already plays in the primary demand and is gradually expanding to an increasing number of workflows.

The Local Lords: Plays in the primary demand within a vertical.

Vertical Saas providers like ServiceTitan and CCC Intelligent Solutions are well positioned to strengthen their vertical play and serve as the central interface for all other applications to integrate in.

Owing to the narrower scope of vertical plays, vertical super-apps can have a lot more integration than just a co-pilot interface. It is far easier to build a fully integrated workflow once an app gains a dominant position. This is because a small use case within a narrow vertical would lack the TAM (total addressable market) to support an independent business.

In all likelihood, consolidation within verticals will follow a ‘build’ path rather than a ‘buy’ path to benefit from this integration advantage.

Embedded without cause: Plays in the secondary demand across verticals.

Most large software providers have thus far played over here. They’ve focused on integrating software solutions instead of providing an integrated decision support and workflow interface.

Software providers that fail to take over workflows and decisions, despite bolting on Gen AI, will continue to play in this space.

Despite playing in the secondary demand, these players may enjoy incumbency advantages as too many other applications from across verticals already connect to them.

However, if one of the BigTech players succeed in moving into the primary demand and creating a horizontal layer to integrate workflows, these players may find their task cut out.

Graveyard of Wannabes: If you are neither horizontal nor do you play in the primary demand, you’re not really positioned to be a super-app.

Most single-use-case enterprise application providers actually sit here. They may bolt on some Gen AI, launch a co-pilot, but the narrow scope of their use case, combined with their inability to take over the decision and workflow interface keeps them disadvantaged.

To understand this framework in more detail, have a look at this article:

Rebundling the enterprise application ecosystem

Much like WeChat, an enterprise super-app eventually needs to rebundle across all applications and create an alternate decision and workflow execution interface.

This is where Gen AI provides a unique play.

As I explain in Vertical AI:

Business workflows are scattered across silo-ed software.

To actually get work done, these workflows have to be rebundled towards a business goal. You take the output of workflow X, Y, and Z, and make decisions or take actions towards a goal. This bundling of workflows towards a goal is performed by human managers.

Managers in organisations achieve this bundling by solving two problems:

The plumbing problem i.e. coordinating across silo-ed workflows

The goal-seeking problem i.e. using diverse workflows to achieve an organisational goal

In today’s B2B workflow, managerial resources in an organization serve as the locus of rebundling.

But Gen AI creates a new locus of rebundling by solving both the plumbing (coordination) and the goal-seeking problem in a single interface.

Two factors determine how effectively rebundling can be achieved towards an enterprise super-app play.

Do applications in the ecosystem open out their resources for integration into the AI platform?

Is the AI sophisticated enough to deliver the value of the model and context into the decisions and workflows enabled by partner applications?

With increasing interoperability, the hub position is achieved through API integration with the AI platform. With increasing sophistication of an AI agent, that hub position is achieved by virtue of the fact that the agent takes over managerial effort so the user primarily engages with workflows through the agent.

To learn more about how this rebundling plays out, have a look at this article:

Dominating your competitive ecosystem

The idea of an enterprise super-app is fundamentally the idea to sit at the center of the enterprise application ecosystem.

But it’s only part of a more comprehensive ecosystem strategy.

To gain the strongest position in the ecosystem, you need to map out your ecosystem and identify the key business models within it which provide you greatest strategic leverage and where you have a right to execute through ownership of the key control points.

If you’d like to discuss this further, please write in to tripta@platformthinkinglabs.com or reply to this email.

Super useful approach. I spent a lot of time in China when WeChat was rising to dominance and the simplicity and comprehensive nature of what they did always struck me. I really liked your use of "primary and secondary" aspects in this. I can definitely think of a number of plays that come out as "local lords" or "embedded without a cause". I have been spending some time mapping different ecosystems and this and previous frameworks are super useful. Thanks for sharing