Gen AI companions and the fight for the primary interface

The race for the primary interface in the age of AI

Everyone (and their dog) wants to build a Gen AI companion… or co-pilot… or assistant… or sidekick.

You get the drift!

Yet, users don’t want hundreds of companions. Ideally, a user wants just one. A single AI companion that partners with them across their entire spectrum of needs.

Winning at the Gen AI companion game is a unique opportunity to gain control of the primary interface.

How exactly do you pursue this opportunity and who’s best positioned to win here?

This post is third in a series of posts on competitive advantage with Gen AI. You can view the first two at How to lose at Gen AI and How to win at Gen AI.

Let’s dig into this one!

How to productize a companion

What do companions do?

Our real-life companions combine three key attributes.

They have empathy, they understand us deeply. They bring expertise to a situation (particularly if they play the role of assistant, advisor, mentor, or coach). And they have the ability to engage and influence.

Companions combine empathy, engagement, and expertise.

Empathy requires deep understanding. This is productized and scaled digitally through data capture and learning models.

Engagement and the right to be a companion requires real-world connection. Over the past decade, we’ve perfected the (dark) art of productizing this through habit design.

Expertise requires knowledge. This is now productized through LLMs and subsequent fine-tuning towards a context.

Over the past decade, we’ve combined empathy (data capture) with engagement (habit design) to capture the primary interface. The news feed (think Facebook), the infinite scroll (think Pinterest), and the infinite swipe (think TikTok) have all worked on this paradigm to gain an ever-increasing share of the primary interface.

GenAI presents a potential discontinuity to that paradigm by leveraging expertise to dismantle the advantages of empathy (share of data) and engagement (share of usage).

Or, conversely, as I explained in How to lose at Gen AI, it will merely reinforce the ‘companion’ position of current players, who will combine their advantages in data capture and habit design to now embed expertise into their interface.

Owning the primary interface

Owning the primary interface is the key source of competitive advantage in the attention economy. When attention is scarce, whoever can harness that attention and then allocate it amongst partners occupies the strongest position in an ecosystem.

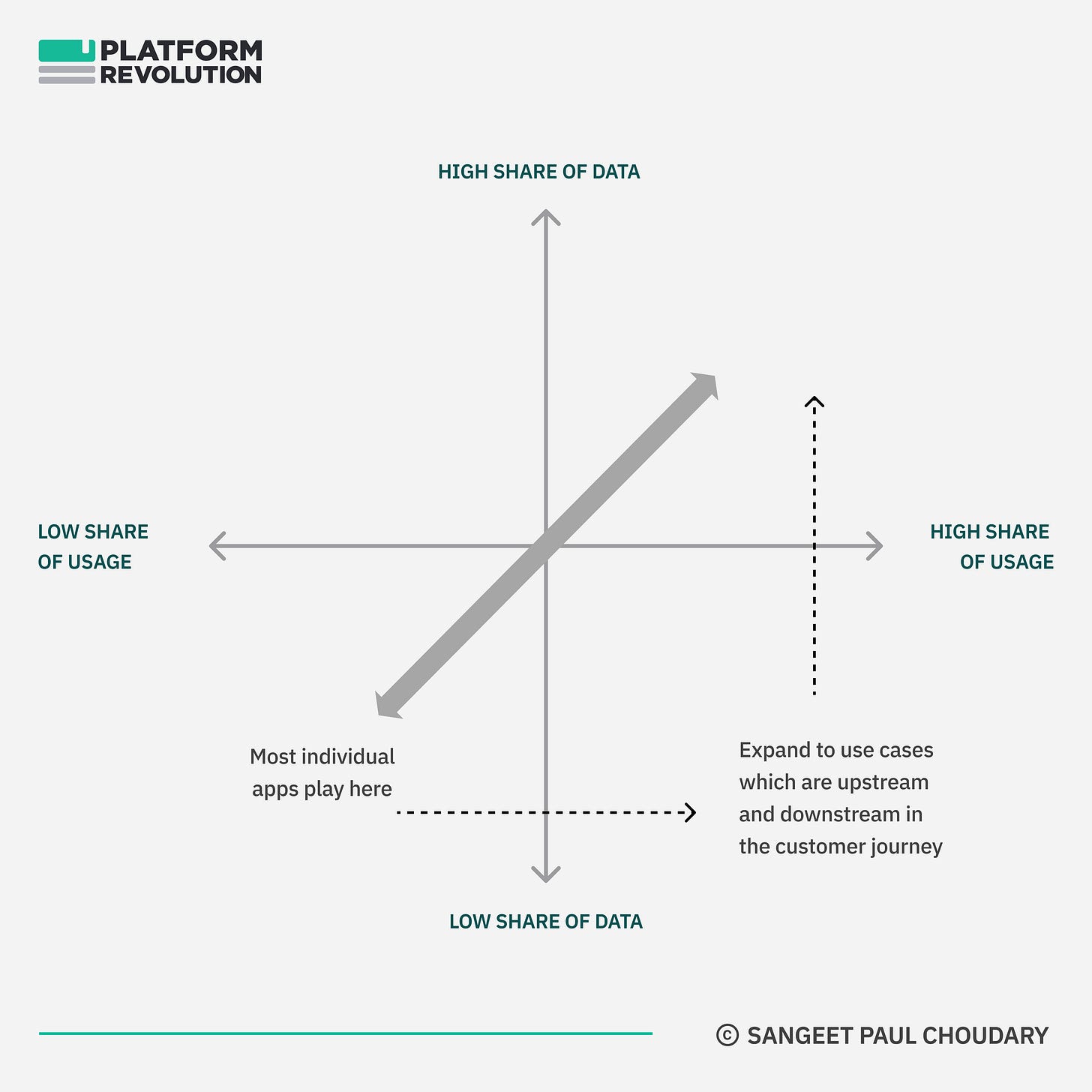

To create a primary layer across the spectrum of use cases, you need to :

Maximize usage on your interface

Maximum data capture through your interface (or even outside it)

Every player wants to move up the Companion Index and capture higher ‘share of usage’ and ‘share of data’ across the user’s life.

So who’s best positioned to go for the primary interface?

Let’s dig in with a few examples!

Incumbent plays for the primary interface

Before the recent improvement in LLMs, most players relied on data capture and habit design to gain the right to win the primary interface.

These players leveraged one or more of four common paths to gain control of the primary interface and they are the best positioned to further cement that dominance leveraging AI.

1. High engagement on the core use case

One path up this index is for a player to deliver high engagement on its core use case. A social product which gets progressively better at personalising its news feed is an example of breaking out from the bottom-left to the top-right quadrant.

This is the most common way in which aggregators have gained control over the primary interface.

AI companion bundling:

An AI companion can be bundled here to improve stickiness on the primary interface, either by improving generative capabilities to support content creation use cases or by improving navigability and discovery, using an assistant.

2. The super-app path

Another path up this index is to extend your dominant position in one use case to then extend to adjacent use cases.

As we’ve seen before, if you’re looking to be a super-app, you will most likely fail. The test of a super-app is not in its ability to house multiple apps, it is in its ability to first win the primary interface and only then (eventually) extend that dominance by adding more use cases.

In China, WeChat owns the primary interface. It is that one super-app which can claim to have the right to the primary interface.

As I explain in How to win at Gen AI:

WeChat started as an individual app with vertical advantage in gaming and communication. However, it moved on to use its dominance in communication to establish primacy of user relationship as the default communication channel. It then integrated communication with payments to control the two most important horizontal capabilities that allowed it to establish a new layer on top of the underlying OS.

Users spent most of their time inside WeChat. Users never left the WeChat workflow because of its all-in-one connective workflow of communication and payments across apps.

When a player starts out on the super-app journey, it gains share-of-usage by increasing engagement and driving habit creation on the core use case. But once it expands to other use cases as a super-app, its ability to expand share-of-usage is determined by its ability to effectively manage workflow across multiple use cases that it now supports.

AI companion bundling:

On super-apps, AI companion bundling delivers competitive advantage to the extent that it can improve workflow coordination across the various use cases that the super-app supports. Instead of having to switch in and out of different mini-apps and chat interfaces, an AI companion can string together the entire experience by acting as a single interface through which all these services are accessed and activated. Eventually, this can also help a super-app extend share-of-usage across new use cases without having to bundle them as new mini-apps inside the interface.

3. The workflow hub

B2B SAAS players, which gain share-of-usage by dominating a specific use case, subsequently establish themselves as a workflow hub by encouraging integrations with other SAAS products. This is a common pattern as B2B users avoid fragmenting their workflows and would rather have multiple apps integrating into a central workflow hub.

Over the past several years, Hubspot has increasingly sought to pursue this strategy. Project management software providers like Asana also bet on gaining share-of-usage and share-of-data through this strategy.

AI companion bundling:

B2B workflow hubs are natural positions for AI companion bundling. An effective AI companion can help reduce cognitive overload associated with multiple integrations and task switching and serve as a central point of interaction across the integrations and the integrated workflow.

For product teams at the central workflow provider, this also reduces the cost of serving multiple personas by creating different workflows across the integrations for different personas. An AI companion can rebundle multiple capabilities to best serve a persona’s needs moving the burden of rebundling integrations away from product managers to AI agents managed by users.

4. The BigTech walled garden

BigTech walled gardens combine the best of all three paths above. They gain high share-of-usage on at least one use case, effectively expand through multiple use cases, and in the case of Google Workspace, Amazon Prime, and Microsoft Dynamics/Office, they also have set up quasi-workflow-hubs.

Google, for instance, is well-positioned to win this game. By owning multiple services (Mail, Maps, Chrome, Photos, YouTube, Drive, Meet etc.), Google owns a lot of the components that, together, expand share-of-usage and share-of-data.

Amazon provides another example of this playbook, as I explain in Why offline retailers fail at online marketplaces:

Amazon runs the world’s most successful membership program. It’s called Amazon Prime.

Prime’s value constantly increases as a bundle. It is no longer simply about 2-day deliveries. It also bundles movies and music. JP Morgan estimates that the value users get from Amazon Prime is worth at least 6 times what it costs.

AI companion bundling:

BigTech walled gardens, again, are well-positioned to shift greater share of usage to their walled garden.

First, much like all the examples above, an AI companion can deliver integration advantages across multiple services and workflows, by leveraging rebundling by AI agents.

Second, AI companions internalize decision-making and absorb decisions/choice away from the user. This means Google can increasingly move from showing 10 results to the user to effectively start showing one single result with Bard, with AI making the choice and moving the locus of choice away from the user.

The incumbent’s business model advantage

BigTech have an important business model advantage in bundling AI companions.

They stand to benefit from

(1) Protection and reinforcement of current profit pools, and

(2) Promotion and preferencing of high margin services.

First, as I shared in How to lose at Generative AI:

Incumbents can subsidize AI by bundling it with an existing already-working profit pool. Startups, instead, need to charge for AI. Workflow-only startups that gain traction but don’t own a proprietary model may get stuck with a huge LLM API bill, making AI subsidization untenable even with heavy VC funding.

Second, BigTech players increasingly engage in self--preferencing - i.e. Google shows its own results at the top and Amazon pushes into new categories as the retailer. As AI-enabled interfaces absorb choice away from the user and as user habits are designed towards being recommended the one right solution instead of having to wade through multiple options, the BigTech gain a greater license to engage in self-preferencing. If users expect Google Bard to proclaim the one right answer, Google has demonstrated that it is sufficiently incentivized to present its own high margin solution as the best one.

Challenger plays for the primary interface

Now that we’ve covered incumbent plays, how exactly can challengers win the right to the primary interface?

1. Verticalize and win

The first option is to go it alone and gain share-of-usage with a vertical solution.

As I explain in How to win at Generative AI:

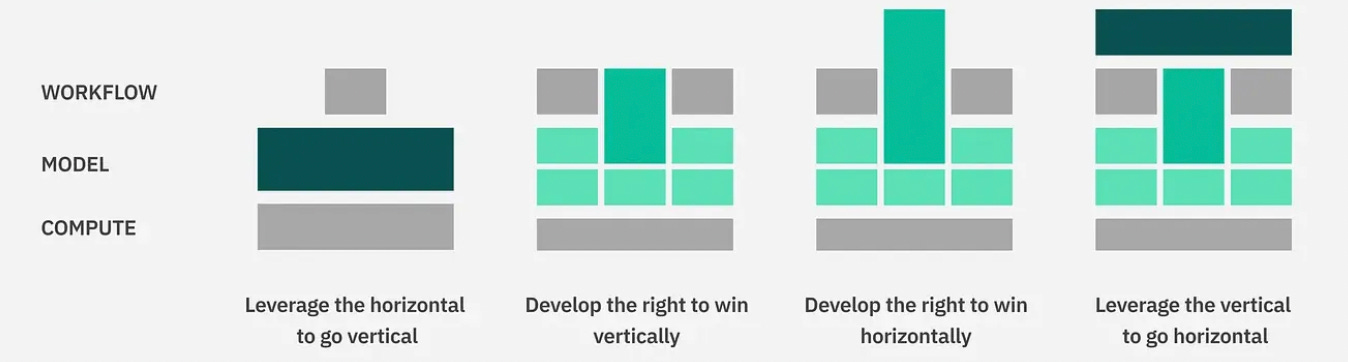

Model fine-tuning helps build proprietary vertical advantage by:

Improving model performance for that specific use case

Reducing model size/costs and improving model economics

Smaller models, trained on domain-specific data deliver better performance on latency, accuracy, and cost than larger foundational models. This verticalization has its own reinforcing feedback effect. The more you develop vertical advantage, the more competitive you get on all parameters.

To deliver the most compelling vertical solution over time, the more the model is fine-tuned, the more deeply coupled future UX changes should be with the model in order to deliver the benefits of that model into the user workflow.

With this vertical advantage developed as a starting point, the challenger needs to go horizontal in order to increase share-of-usage. I explain this further in that post using the following framework:

Read about this in-depth at:

How to win at Generative AI

A couple of weeks back, I wrote a post on How to lose at Generative AI. Which raises the counter-question, how do you win at Generative AI? Of the many GenAI copycats emerging, which are the few that win? This post is about winning at Generative AI.

2. Partner with category leaders in low engagement categories

A challenger may also partner with an incumbent who has low share-of-usage and low share-of-data but nonetheless has a huge installed base.

Consider a leading travel portal like Expedia or Booking. Their share-of-usage and share-of-data across a user’s spectrum of usage is miniscule compared to that of Facebook or Instagram. Despite the fact that they are leaders in their own category, they can never gain share-of-usage significant enough to be a primary interface.

In this case, an AI companion may be used to gain share of usage through adjacent use cases that require expertise, without requiring deep user data. For instance, an AI companion that helps users dream about travel, plan out different itineraries, access relevant content to experience those itineraries and eventually book them would augment such category-leader incumbents whose core use case only affords a small share-of-usage.

The AI companion helps expand and cover use cases which lie upstream and downstream from the transaction. It might have been too expensive to serve those use cases in the past but those costs collapse when the cost of developing and embedding that knowledge/expertise collapses.

This is a new way to win vertically, by gaining coverage of upstream and downstream use cases across a vertical (step 2 in the sequence below).

Again, once the AI companion establishes vertical dominance by serving across the end-to-end customer journey for travel, it then develops the right to win horizontally (step 3) and can then expand horizontally (step 4), as users start viewing it as a companion guiding them across their journey.

3. Expanding share-of-data and share-of-usage across a partner ecosystem

Another way to move up the spectrum is to gain data and usage by embedding expertise across a fragmented ecosystem of partners, where each partner has limited share-of-data and share-of-usage.

Unlike the two approaches above, this is primarily a horizontal strategy.

For instance, consider a loyalty product which serves offers and recommendations to the user based on their consumption but where consumption data can be gathered across a larger ecosystem of partners without actively owning the primary interface (e.g. merely by providing the loyalty program number).

With a Gen AI companion, the loyalty product evolves beyond a recommendation engine to additionally guiding users across their interactions with partner services. In this case, the AI companion creates a companion layer not just across an individual partner service but across the entire ecosystem of partner services. Hence, if you use your loyalty card to shop across five different categories, your interactions with the AI companion are no longer vertical-constrained to a single category but extend across multiple categories.

Eventually, as data accumulates, the app’s ability to personalize offers and recommendations also improves, which, combined with the cross-category AI companion, helps it develop the right to share these highly personalized recommendations in an interface of its own.

In this case, horizontal dominance gained through embedding across third party apps and interfaces eventually grants the right to win the horizontal primary interface across all those apps and interfaces.

What’s next?

We’ve talked about seven different ways that AI companions can gain traction and eventually get a shot at owning the primary interface.

There’s one more horizontal play I haven’t called out here. We use it daily but don’t really think go it as an opportunity for situating an AI companion. A large opportunity hidden in plain sight!

Next week’s analysis digs into this opportunity.

> If users expect Google Bard to proclaim the one right answer, Google has demonstrated that it is sufficiently incentivised to present its own high margin solution as the best one.

I’m confused. If I’m using Bard to get one right so sorry answer from a Google search, how are they making any money from their ads? What is the high margin solution tied to Google Bard?

The device makers will own the top-level "personal" companion due to bare-metal access to immediate user data and interactions, as well as interconnected family and household devices secured in-part by the hardware. These will know your voice, fingerprint, and face signatures, your health vitals, your location, and so on. It is *this* companion you will most (only?) truly trust, and so it is this companion that will act as the gateway and liaison to all other branded top-level agents. This companion will translate content from lower-level agents to be linguistically, contextually, and tonally translated and tuned for you, itself tuned by your behavior, responses, interactions, and -- of course -- direct tuning directives.

Maybe it's still Apple vs. Alphabet, or others. But it will be the "things" we literally hold most dear to us -- the actual hardware we use to interact with the digital world -- that retains that most precious relationship.