The 'data moats' fallacy

Moats are never about data alone

This post is based on ideas from my new book Reshuffle, now available in Hardcover, Paperback, Audio, and Kindle formats.

Netflix vs. Blockbuster is one of those well-worn stories that suggest quick and obvious explanations - all of which successfully miss the point.

The first misconception is that Netflix’s streaming beat Blockbuster’s DVD rental. But Netflix was way ahead way before streaming entered the picture.

If you rewind the tape a little further, another generic explanation is Netflix’s better customer experience - no more late fees, no more humiliation at the checkout counter when you returned “Titanic” three days late.

Those explanations fit the narrative we want to believe, that a plucky upstart delighted customers and the lumbering incumbent was too slow to adapt.

The trouble is, Blockbuster did adapt. Once Netflix’s no-late-fee policy started luring away customers, Blockbuster eliminated late fees too. When Netflix’s DVD-by-mail model gained steam, Blockbuster copied that as well, complete with its own red envelopes. On the surface, it matched Netflix feature for feature. Yet Blockbuster still collapsed.

Finally, the last bastion of defence: Netflix had better data, which helped it personalize recommendations for its customers.

Sounds right, you might expect.

But it’s yet another case of true, but utterly useless.

The real reason - fulfilment architecture

This post is not about Netflix vs Blockbuster but understanding why Netflix beat Blockbuster really helps us understand a larger point about where competitive advantage really lies.

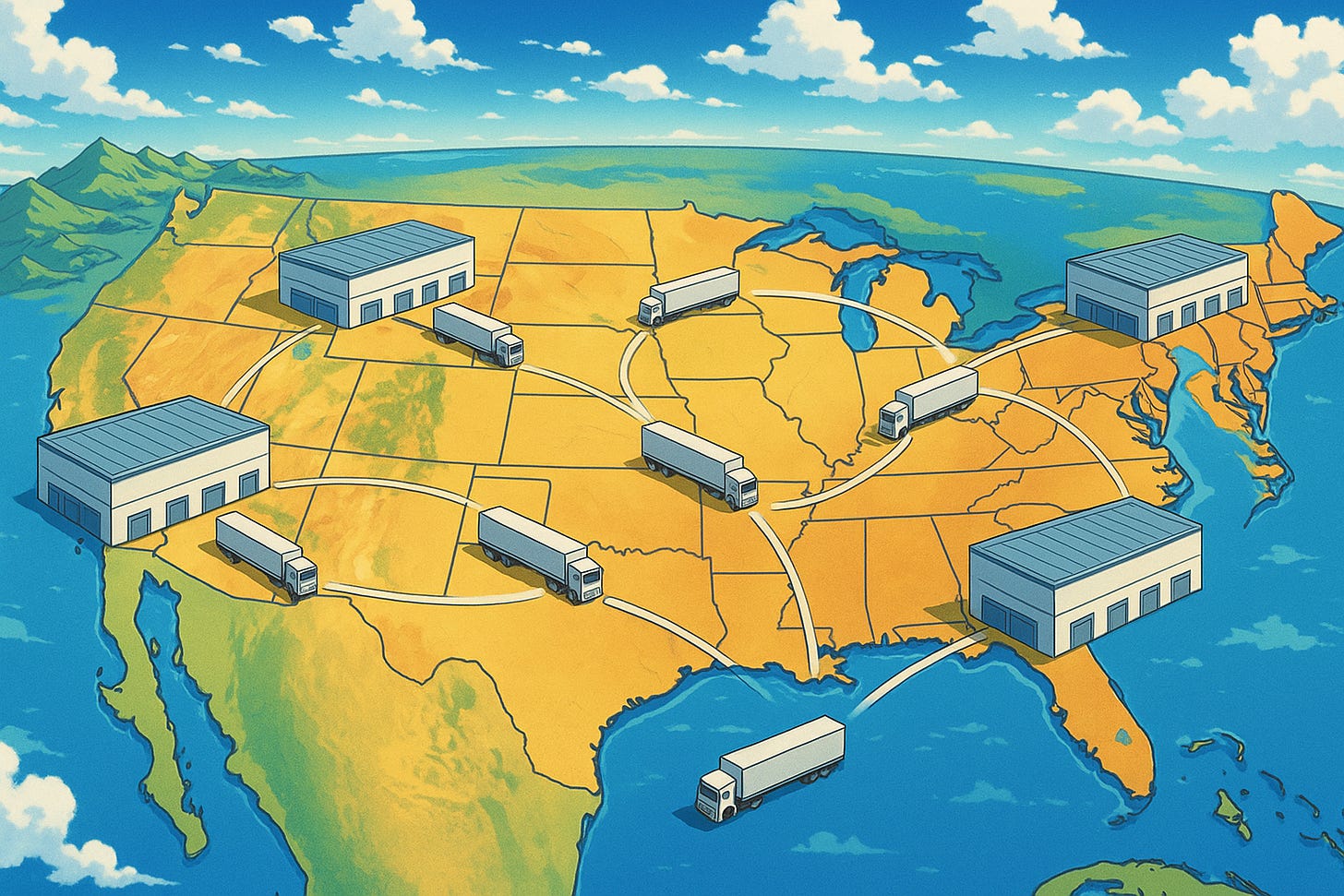

In a 2020 post, Amazon is a logistics beast, I explain what really helped Netflix stand out:

The one thing that Blockbuster could never compete with was the integration of demand-side queuing data (users would add movies that they wanted to watch next into a queue) with a national-scale logistics system. All this queueing data aggregated at a national scale informed Netflix on upcoming demand for DVDs across the country.

Blockbuster could only serve users based on DVD inventory available at a local store. This resulted in:

1) low availability of some titles ( local demand > local supply), and

2) low utilization of other titles (local supply > local demand).

Netflix, on the other hand, could move DVDs to different parts of the US based on where users were queueing those titles. This resulted in higher availability while also having fewer titles idle at any point.

Queueing data improved stocking and resulted in higher utilization and higher availability. It allowed Netflix to serve local demand using national inventory.

I explain this further in Why offline retailers fail at online marketplaces:

There was no way for Blockbuster to compete with Netflix within the framework of local inventory - local fulfilment. Netflix fundamentally changed that framework.

This Netflix parable is important - it helps us identify a key factor that drives the competitiveness of companies in the age of data and AI.

Debunking the ‘data is our moat’ fallacy

The “data is our moat” fallacy is the belief that simply accumulating large amounts of proprietary data automatically creates a durable competitive advantage.

The logic goes like this: data is scarce, data is valuable, and the company that collects the most will be hardest to dislodge.

This assumption is flawed for several reasons. Data is often substitutable, its marginal utility declines rapidly in most cases, and features built on data are copyable.

Defensible advantage in data-driven businesses does not come from having data in isolation, but from the data-informed architecture a company builds.

What matters is the architecture that emerges when data is embedded in the system itself. Netflix’s queue created an entirely new operating model. Competitors could mimic features and even acquire similar datasets, but they could not easily rip out and rebuild their architecture without unraveling their existing model.

The puzzle of Netflix versus Blockbuster, in other words, was not about who had the data, but about who used it to reconfigure the logic of the business. Blockbuster never escaped the gravity of its old architecture.

In short, the fallacy is mistaking data as an asset in isolation for data-informed system design. The former is often transient; the latter, when well-architected, can produce durable advantage.

The architecture is the moat

Competitive advantage in data-driven businesses comes less from the data itself and more from the architecture that data makes possible.

In any complex system, outcomes are shaped less by individual parts than by how the parts are arranged - the feedback loops, buffers, and flows that govern behavior over time.

Data provides visibility, but it is the architecture that determines how variability is managed and how guarantees are met.

A well-designed architecture creates reinforcing loops: better forecasts reduce variance, which improves reliability, which attracts more usage, which in turn generates better data. These loops compound, widening the gap between firms that embed data into their structures and those that treat it as an add-on.

Once an architecture is built, it channels behavior in ways that are difficult to reverse. Changing it requires not just new inputs but dismantling and reassembling the system itself.

In this sense, architecture becomes the true moat. It is the pattern of interconnections, informed by data, that locks in compounding performance improvements and makes imitation prohibitively costly.

The AI-first series

This post is fourth as part of an ongoing series on AI-first companies.

You can see the previous posts below:

Data unlocks architectural moves

Data can help unlock a range of architectural moves. Four prominent ones are particularly interesting in the case of order fulfilment as with Netflix above.

1. Risk pooling

Without data, firms guess demand locally, leading to frequent stockouts in some stores and excess in others. With data, firms can forecast across a wider population, consolidate inventory, and reduce variance.

Centralizing stock reduces the safety buffer required to meet uncertain demand. Netflix did this with DVDs. Instead of guessing what each neighborhood wanted, it pooled demand nationally, shipping from a central stock based on queue data.

Amazon uses a similar principle with regionally optimized fulfillment centers, dynamically reslotted as demand signals shift.

These data-informed fulfilment architectures can promise availability with fewer assets, something a competitor tied to a local inventory model cannot easily match.

2. Demand shaping

Data allows companies to manage demand, not just respond to it.

Netflix’s queue was an early example. By asking customers to line up what they wanted, it smoothed out variability and gave the firm foresight into future demand.

Amazon does this through delivery-date promises; the moment a customer sees arrives Thursday, they are committing to a slot that Amazon has calculated it can meet.

In India, quick-commerce players use batching windows - “delivery in 10 minutes” versus “within 30 minutes” - to steer demand toward times and routes that make the network most efficient.

Here, the promise itself becomes the product. Competitors may have similar goods, but without a system designed to manage promises at scale, they cannot compete on reliability.

3. Postponement

The later you commit, the more accurate your decision, because uncertainty reduces as time passes. Data makes postponement feasible at scale.

Amazon leverages robotics and sortation systems that hold orders in a “ready-to-ship” state until late in the cycle, when routing decisions can be made with fresher data.

Quick-commerce firms prepare pods of popular items in dark stores, holding off on final assignment until the last minute. The architecture absorbs uncertainty by delaying commitments until predictions are more accurate.

The outcome is higher reliability without excess cost. Replicating this requires both better forecasts and physical and organizational systems designed for late-binding decisions.

4. Economies of density

Perhaps the most powerful effect of data-informed architecture is the shift from scale to density.

Traditional firms think in terms of growing volume nationally, but in last-mile systems, what matters is the number of orders per square kilometer per hour. Data allows dynamic routing and clustering so that each new order in a neighborhood reduces delivery cost and time.

Dark stores placed close to demand, riders dispatched in batched clusters, and vans leaving fuller as local demand grows - all these effects create non-linear efficiency gains. This is what makes quick-commerce viable: the system compounds as density increases.

A competitor operating on a broader but thinner footprint can grow overall volume but will never match the cost curve in dense zones without restructuring around the same principle.

This post is based on ideas from my new book Reshuffle, now available in Hardcover, Paperback, Audio, and Kindle formats.

Deep-dive and framework

Now that we’ve covered the core idea, the rest of the post (paywalled) gets deeper into the application:

Unpack the ideas above futher by diving deeper into e-commerce and quick-commerce fulfilment architectures.

Extend the AI-first thesis that we’ve been developing across the past 3 posts.

Close with the final framework: The five tests for an architectural moat

Keep reading with a 7-day free trial

Subscribe to Platforms, AI, and the Economics of BigTech to keep reading this post and get 7 days of free access to the full post archives.